- Investinq

- Posts

- 🧐 US Intel Stake?

🧐 US Intel Stake?

+ Buffett’s Berkshire Buys $1.6B in UnitedHealth, Trims Apple Stake

Good afternoon! Cursor, the $9.9 billion AI coding startup, has a quirky office rule: no shoes allowed. Employee Ben Lang shared a photo of sneakers and loafers piled at the San Francisco entrance, sparking everything from “smelly feet” jokes to praise for the cozy vibe. Lang noted it’s not his first shoeless workplace — productivity app Notion had the same rule. The tradition, common in parts of Asia and Scandinavia, is meant to keep outdoor dirt from coming inside.

Other startups have embraced the policy for cultural or comfort reasons, sometimes offering heated floors, cubbies, or even a “slipper stipend.” Speak, a language-learning app, ties its rule to its first market, South Korea. And while Lang’s snapshot showed a bit of chaos, companies can make it neater with branded socks, organized storage, or shoe covers. As for the odor fears? Experts say feet often smell less without shoes trapping sweat and bacteria — so maybe those barefoot engineers are onto something.

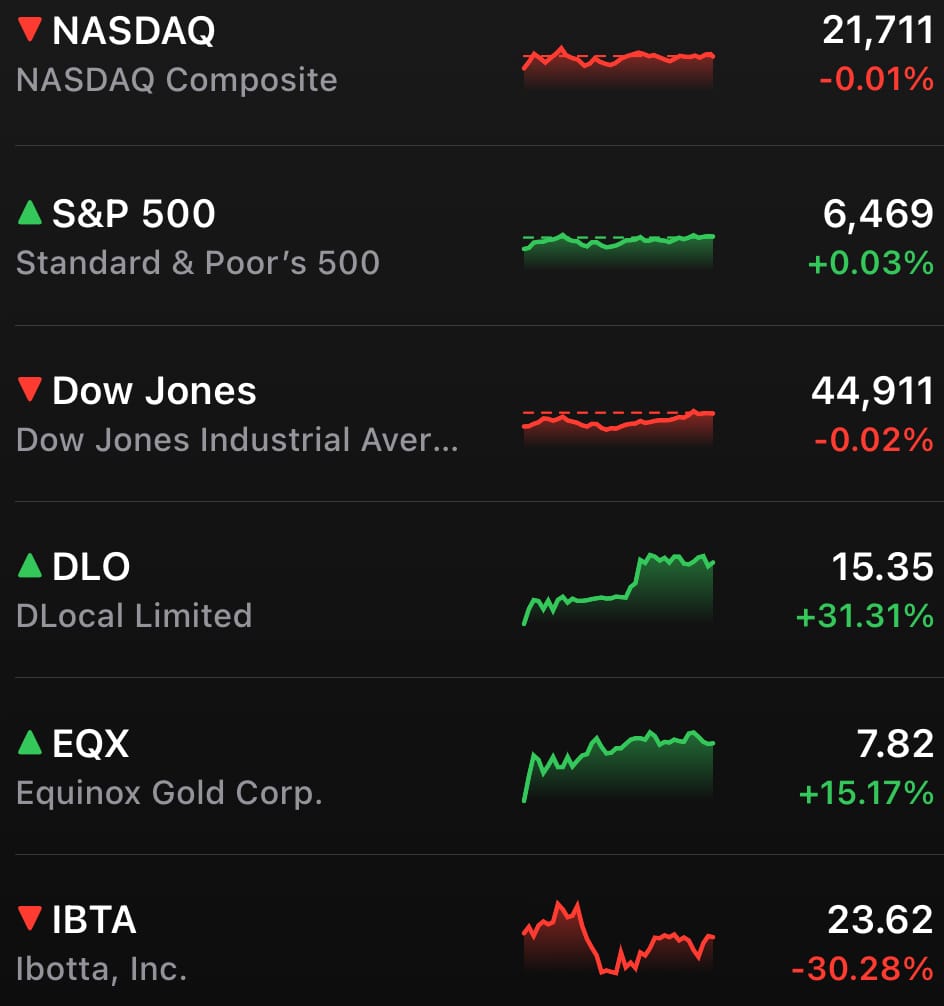

MARKETS

Stocks opened in the red after July’s hotter-than-expected producer price index dashed hopes for a September rate-cut bonanza. Small caps bore the brunt, with the Russell 2000 sliding more than 1%, while the S&P 500 and Nasdaq 100 clawed back to finish barely changed. Health care and financials led the S&P’s sector pack, while materials ended at the bottom.

Crypto had its own whiplash moment. Bitcoin hit a fresh all-time high just over $124,000 before traders took profits and sent it lower. For equities, the late-day rebound looked like classic dip-buying — proof that even bad inflation news can’t keep some investors on the sidelines for long.

Join 18,000+ Investors at Crypto’s Top Virtual Event

The Crypto Community Summit brings together 27 sharp minds across three packed days to share what’s actually working for them in the crypto markets.

Learn how top investors find early-stage coins, time their entry, and manage risk like pros. You'll also get expert-backed insights to help you level up your crypto strategy—even if you're making your very first trade.

It’s all 100% virtual and 100% free. Claim your spot today.

STOCKS

Winners & Losers

What’s up 📈

DLocal soared 31.31% after reporting a 50% jump in revenue last quarter and receiving an upgrade to buy from HSBC, which cited cost controls and new product launches. ($DLO)

Equinox Gold gained 15.17% after producing 219,122 ounces of gold last quarter, coinciding with record-high gold prices. ($EQX)

Intel popped 7.38% on reports the Trump administration is considering taking a stake in the semiconductor giant. ($INTC)

Bullish rose 2.90% on day two of trading, continuing momentum from its 83% surge in Wednesday’s IPO debut. ($BULL)

Miami International Holdings jumped 33.65% in its first day of trading after pricing its IPO at $23 per share. ($MIAX)

What’s down 📉

Ibotta plummeted 30.28% after missing Q2 earnings and revenue estimates and lowering fiscal guidance. ($IBTA)

Coherent fell 19.61% after meeting Q4 expectations but issuing weaker-than-expected forecasts for the next quarter. ($COHR)

Deere & Co. slid 6.76% despite beating estimates, as price cuts to maintain demand raised investor concerns. ($DE)

Advance Auto Parts dropped 8.02% after falling short of quarterly expectations and cutting its full-year outlook. ($AAP)

Cisco Systems slipped 1.38% after a narrowly better-than-expected quarter and guidance that matched forecasts. ($CSCO)

INVESTMENT

U.S. in Talks to Take Stake in Intel to Boost Chip Manufacturing

Intel’s stock jumped 7% Thursday after Bloomberg reported that the Trump administration is in talks to take a stake in the struggling chipmaker. The move would help fund U.S.-based manufacturing, including Intel’s delayed Ohio plant, and marks the latest in a string of high-profile government interventions in private industry. Intel, the only U.S. firm capable of producing the fastest chips domestically, has faced mounting pressure from Washington to expand stateside production as part of a broader push to secure critical tech supply chains.

Political Tensions and CEO Scrutiny

The talks come just days after President Trump called for Intel CEO Lip-Bu Tan’s resignation over alleged ties to China, claims Tan has denied. On August 11, Tan met with the administration to address those concerns and discuss collaboration opportunities, reportedly sparking the idea of a direct government stake. Intel has not confirmed the discussions, saying only that it remains committed to advancing U.S. national and economic security interests.

Intel’s Foundry Struggles

Tan, who took over earlier this year, inherited a company struggling to gain ground in AI chips and still searching for major customers for its foundry business, which manufactures chips for other firms. In July, Intel canceled plans for new sites in Germany and Poland and slowed development in Ohio, citing tighter cost controls. A government investment could help reverse that slowdown and send a strong signal to potential foundry clients.

Part of a Broader Industrial Strategy: The possible Intel deal follows similar moves by the Trump administration. Last week, it secured a 15% cut of certain Nvidia and AMD chip sales to China. The Pentagon recently bought a $400 million stake in MP Materials, the U.S.’s only rare-earth miner, and the White House took a “golden share” in U.S. Steel to influence key corporate decisions. If completed, the Intel investment would further cement the administration’s role as an active player in strategic industries.

NEWS

Market Movements

📈 Producer Prices See Hottest Jump Since 2022: July’s PPI and core PPI each jumped 0.9% month over month, far above the 0.2% forecast. Financial services inflation, especially in portfolio management, drove the surge. The surprise hasn’t altered expectations for a Fed rate cut in September. However, it highlights persistent cost pressures that could flow into consumer prices.

🚨 Bumble Plunges After Major Stake Sale: Bumble shares fell over 15% after founder Whitney Wolfe Herd and top shareholder Blackstone moved to sell more than 17% of the company. Blackstone registered nearly 16.7M shares for sale, while Wolfe Herd filed to sell about 1.4M shares. The sales follow a disappointing Q2 loss and weak sales growth. Shares were also hit by Blackstone’s sale price being well below Wednesday’s close.

⚠️ Hims Drops on FTC Probe: Hims & Hers shares slid after reports the FTC is investigating its advertising and cancellation practices. The probe has been ongoing for over a year following consumer complaints. The company confirmed it was cooperating with the inquiry but didn’t provide details. Shares dropped further in after-hours trading on the news.

🤖 OpenAI Sets High Bar for ChatGPT in Sensitive Moments: ChatGPT head Nick Turley said the goal is to make the product safe enough to recommend “unequivocally” to a struggling family member. His comments follow reports of users forming unhealthy emotional ties with AI chatbots. OpenAI is rolling out overuse alerts and distress detection to address such risks. Turley emphasized that the company won’t stop improving until it meets that safety benchmark.

📉 Citron Targets Palantir Valuation: Short seller Andrew Left called Palantir’s market multiple “absurd” and predicted a possible 50% drop. Despite strong earnings, he’s betting against the stock but admits timing is tricky. Heavy retail investor momentum could keep prices high for now. Left has a history of big short-selling wins and controversies.

👥 Retail Traders Drive Institutional Moves: JPMorgan says retail traders are pulling institutions into high-beta and meme stocks. Retail buying has outpaced non-retail activity in recent months. Analysts warn this herding behavior could reverse quickly on policy changes or weak data. The trend underscores retail investors’ growing influence in market dynamics.

🛒 Amazon Wins Praise for Grocery Push: Analysts applauded Amazon’s nationwide free same-day grocery delivery for Prime members. They see it as a $90B opportunity that strengthens customer engagement and loyalty. The $25 free-delivery threshold puts pressure on rivals like Instacart and Walmart. Many expect the move to boost Amazon’s e-commerce share.

🚀 TeraWulf Soars on AI Hosting Deal: Shares surged over 59% after securing $3.7B in AI hosting contracts with Fluidstack. Google is backing $1.8B of lease obligations and taking an 8% stake. The deals could grow to $8.7B with extensions. The expansion includes new high-performance computing facilities in New York.

💻 Foxconn’s AI Gains Offset Apple Declines: Foxconn expects AI server revenue to more than double in Q3, fueled by Nvidia demand. Its consumer electronics business, including iPhone production, is shrinking. This shift reflects a broader move toward AI-driven hardware demand. The company’s outlook highlights the changing balance in tech manufacturing.

🖥 Oracle and Google Partner on Gemini AI: Oracle and Google have teamed up to offer Google’s Gemini AI models through Oracle’s cloud services and business applications. The partnership expands Oracle’s AI capabilities and integrates advanced language models into its enterprise offerings. Both companies see the move as a way to strengthen their positions in the competitive cloud market.

⌚ Apple Restores Blood Oxygen Monitoring to US Watches: Apple is bringing back blood oxygen monitoring features to its Apple Watches in the United States. The move follows previous restrictions tied to ongoing patent disputes. Users will regain access to the health-tracking tool via a software update.

🚗 GM Unveils All-Electric Cadillac Elevated Velocity: General Motors revealed the Cadillac Elevated Velocity, a concept car designed to expand the brand’s all-electric luxury crossover lineup. The sleek concept highlights Cadillac’s commitment to high-end EV innovation. GM says the model reflects its vision for the future of luxury mobility.

TRADE

Buffett’s Berkshire Buys $1.6B in UnitedHealth, Trims Apple Stake

Berkshire Hathaway stunned Wall Street by revealing a fresh $1.6 billion stake in UnitedHealth, a company battered by scandal and share price declines. The conglomerate scooped up over 5 million shares in Q2, making it the 18th-largest position in its $300 billion equity portfolio. While the move bears Buffett’s hallmark of bargain-hunting, many believe his deputies Todd Combs or Ted Weschler led the charge just as they did with Amazon years ago. Shares surged more than 6% after-hours on the news.

A Troubled Insurer Gets a Lifeline: UnitedHealth has been at the center of a Justice Department investigation over Medicare billing and is still reeling from its CEO’s May resignation. The company yanked its full-year outlook earlier this year and later reissued one that fell short of Wall Street’s expectations. Buffett has long criticized America’s health care costs, even once calling the system a “tapeworm” on the economy. While a prior healthcare venture with Jeff Bezos and Jamie Dimon fizzled, this buy shows Berkshire isn’t done making moves in the space.

More Than Just One Buy

UnitedHealth wasn’t Berkshire’s only shopping trip last quarter. The firm also snapped up small stakes in Nucor, Lamar Advertising, Allegion, and re-entered homebuilders Lennar and D.R. Horton. These buys added diversification to Berkshire’s holdings, and the market reacted swiftly Nucor popped nearly 8% after-hours, while Lennar and D.R. Horton climbed about 3% each.

Trimming the Apple Tree: The filing also revealed Berkshire sold 20 million shares of Apple in Q2, continuing a reduction that began last year. Despite the trim, Apple remains Berkshire’s largest holding alongside American Express, Bank of America, Coca-Cola, and Chevron. Apple’s stock, trading at about 30x forward earnings, slipped slightly in after-hours trading and is down 7% this year. Buffett has repeatedly praised CEO Tim Cook, and while Berkshire’s stake is smaller, it’s still a cornerstone of the portfolio.

Calendar

On The Horizon

Tomorrow

This week’s economic lineup ends with a modest but meaningful finale. Friday brings a triple shot of data: July retail sales to see if shoppers are still swiping, a first read on August consumer sentiment, and the import price index for a pulse check on global trade flows.

Corporate earnings? Practically a ghost town. With no marquee names on deck, markets will have the bandwidth to focus squarely on the data

NEWS

The Daily Rundown

🛋 Ikea Appoints First Non-Swedish CEO: Ikea’s Ingka Group named Spaniard Juvencio Maeztu as its new CEO, marking the first time a non-Swede will lead the world’s largest IKEA retailer. Maeztu began as a store manager in Spain in 2001 and most recently served as deputy CEO and CFO. He will succeed Jesper Brodin on November 5, with Brodin staying on as an advisor through February. The leadership shift comes as the company focuses on price cuts and navigating global supply challenges.

🍏 Apple Plans AI Comeback With Robots, Lifelike Siri: Apple is preparing a major AI push with products like a moving tabletop robot, a lifelike Siri avatar, smart speakers with screens, and home-security cameras. A Pixar lamp-style robot is targeted for 2027, while a smart-display speaker is expected by mid-2026. The initiative aims to restore Apple’s edge in innovation and smart-home integration. Analysts see it as a direct play to reclaim its tech leadership from rivals.

🏦 Fed Chair Search Narrows From 11 Candidates: The Trump administration is vetting up to 11 candidates to replace Jerome Powell when his term ends in May, including Fed officials and private-sector executives. Treasury Secretary Scott Bessent is overseeing the process, with Trump hinting the shortlist is down to three or four. The president plans to announce the pick earlier than expected. The decision is expected to signal a shift in monetary policy direction.

🍺 Alcohol Consumption Hits Historic Low in US: Only 54% of Americans say they drink alcohol, the lowest figure in 90 years of Gallup polling. Health concerns, including studies linking even moderate drinking to higher cancer risk, are a key driver of the decline. Every demographic—by age, gender, income, and political affiliation—has seen drops in alcohol use over the last two years, with Republicans’ drinking rates falling 19 points. Analysts say tight personal budgets and a shift toward nicotine and other alternatives are also hurting alcohol sales.

🇺🇦 European Leaders See ‘Hope for Peace’ in Ukraine After Trump Call: German Chancellor Friedrich Merz said there is “hope for peace” in Ukraine after he and other European leaders spoke with President Trump and Ukrainian President Volodymyr Zelensky. Trump reportedly agreed that any peace plan must begin with a ceasefire and include Ukraine in negotiations. He has recently criticized Vladimir Putin for prolonging the war, warning of “severe consequences” if no ceasefire is reached. Some allies, however, worry Trump could soften his stance during his in-person meeting with Putin in Alaska this week.

💸 NY Attorney General Sues Zelle Over Fraud Claims: New York AG Letitia James is suing Zelle, accusing it of enabling scammers to steal more than $1 billion from users between 2017 and 2023. James says the platform failed to implement basic security measures to prevent fraud. A similar suit from the CFPB under the Biden administration was dropped after Trump took office, but James is reviving the case. Zelle called the move a “political stunt,” while Trump’s Justice Department has opened an investigation into James.

✈️ Air Canada Cancels Flights as Attendants Strike: Air Canada will begin canceling flights today and suspend operations entirely on Saturday after its flight attendants voted almost unanimously to strike. The union is demanding higher wages and the elimination of unpaid work. The airline offered a 38% pay increase over four years but failed to reach an agreement after eight months of talks. Air Canada operates around 430 flights daily between Canada and the US.

🩺 Doctors Got Worse at Detecting Cancer Without AI: A study in Poland found experienced gastroenterologists became about six percentage points worse at spotting pre-cancerous colon growths after losing access to AI tools. Detection rates fell from 28% with AI to 22% without it. Researchers say reliance on AI likely made doctors less attentive when performing procedures unaided. One co-author compared it to suddenly having to navigate without Google Maps after relying on it for years.

REFERRAL

Share Investinq 🤝 Acquire Swag

If you love reading our newsletter, don’t be selfish — share it. Odds are your favorite finance bro, trader, investor, or stock market fanatic will too.

Don’t keep all the market news to yourself — share the love using the unique link below.

We deliver you all the news for free every single day (go on… help us out ;)

And here’s the kicker: every referral you make gets you entered into a raffle to win some awesome prizes listed below. Just share the link below and you’ll be entered once they sign up.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com