- Investinq

- Posts

- 🤑 Klarna Files for IPO

🤑 Klarna Files for IPO

+ Gold Breaks Through $3,000

Good afternoon! Saudi Arabia just pulled off a rare catch — Pokémon Go and your location data. The kingdom’s Public Investment Fund, through its subsidiary Scopely, struck a $3.5 billion deal to acquire Niantic’s gaming business, including Pokémon Go, Pikmin Bloom, and Monster Hunter Now. Pokémon Go has tracked over 100 million players since its 2016 launch, turning neighborhoods and landmarks into hunting grounds — and now that treasure trove of location data is under Saudi control. The deal is expected to close after regulatory approval.

Niantic has struggled to recreate the magic of Pokémon Go, leading to layoffs and canceled projects in recent years. The sale marks another step in Saudi Arabia’s growing influence in gaming — the PIF already holds stakes in Nintendo, EA, and Activision Blizzard. Scopely says it expects to generate over $1 billion in annual revenue from the deal, positioning Pokémon Go to remain a “forever game” — assuming players are comfortable with their next Pikachu hunt being tracked from Riyadh.

MARKETS

*Stock data as of market close*

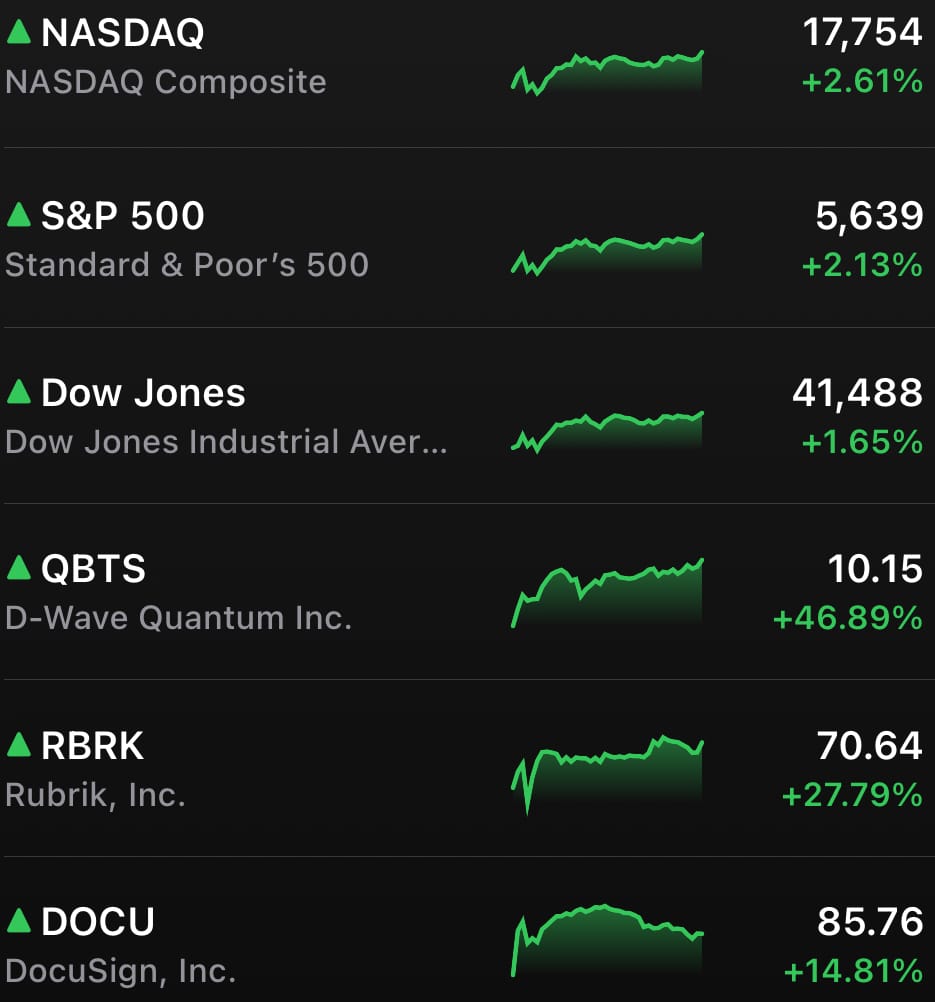

Stocks bounced back Friday, delivering some much-needed relief after a rough week. The S&P 500 climbed 2.1% for its best day of the year, while the Nasdaq jumped 2.6% as tech stocks rallied. The Dow Jones Industrial Average rose 1.6%, adding over 600 points to claw back some of the week’s steep losses. But even with Friday’s gains, the major indexes wrapped up their fourth straight losing week — the longest losing streak since last August.

Investors took advantage of the dip, snapping up beaten-down stocks after a week dominated by trade tensions and economic uncertainty. The rally was fueled by easing concerns over a potential government shutdown and some hints of progress in U.S.-China trade talks. Still, with tariffs looming and the Fed’s next rate decision on the horizon, Wall Street isn’t out of the woods yet.

STOCKS

Winners & Losers

What’s up 📈

Quantum Computing stocks boomed after D-Wave Quantum jumped 46.89% after the quantum computing company reported earnings that impressed Wall Street. ($QBTS). Rigetti Computing popped 28.23% on strong momentum. ($RGTI) Quantum Computing surged 29.14% after D-Wave. ($QUBT)

Rubrik soared 27.79% after the data management company posted a narrower-than-expected loss of 18 cents per share, compared to the 39-cent loss analysts had forecast. Revenue of $258 million also topped the $233 million estimate. ($RBRK)

DocuSign climbed 14.81% after the company posted better-than-expected earnings and revenue. CEO Allan Thygesen highlighted positive momentum from AI-enabled content and partnerships with Microsoft and Google. ($DOCU)

Semtech jumped 21.06% after reporting better-than-expected fourth-quarter results and issuing strong first-quarter guidance. ($SMTC)

PagerDuty gained 17.75% after the company provided optimistic forward guidance, citing strong demand for its incident management platform. ($PD)

Peloton cycled 16.14% higher after Canaccord Genuity upgraded the stock to buy, saying the fitness company has reached a “turning point.” ($PTON)

Ulta Beauty jumped 13.68% after reporting fourth-quarter earnings of $8.46 per share, well above the $7.12 estimate. Revenue also topped expectations, but the company issued cautious forward guidance. ($ULTA)

Crown Castle climbed 10.37% after the telecom infrastructure company announced the sale of its fiber assets to EQT and Zayo for $8.5 billion. ($CCI)

Nvidia gained 5.27%, snapping a three-week losing streak, though shares remain down more than 10% in 2025. ($NVDA)

What’s down 📉

In a Sea Of Green, Here’s what stood out.

Li Auto slipped 4.39% after the Chinese EV maker gave weak guidance, dashing hopes of a near-term recovery. ($LI)

T-Mobile slipped 1.20% after Citi analysts downgraded the stock, citing concerns that the wireless network provider’s valuation may be too high. ($TMUS)

FINTECH

Payments Firm Klarna Files for IPO, Showing 24% Revenue Jump

Buy now, pay later just got a whole lot more interesting. Klarna, the Swedish payments giant known for its installment-based shopping model, has officially filed to go public on the New York Stock Exchange under the ticker KLAR—and the timing couldn’t be more interesting.

From Pandemic Darling to IPO Comeback

Klarna was once the crown jewel of fintech, hitting a $45.6 billion valuation in 2021. But things fell apart fast when interest rates spiked and consumer demand slowed, slashing Klarna’s value to $6.7 billion by 2022. Now, after a sharp rebound, Klarna’s IPO could value the company at over $15 billion.

The company posted a $21 million net income (not the greatest) in 2024 on $2.81 billion in revenue—up 24% from the prior year when it lost $244 million. Operating loss shrank to $121 million from $49 million, and adjusted operating profit hit $181 million—a turnaround Wall Street can appreciate.

Rebuilding and Refocusing: Klarna spent much of 2024 trimming the fat and rebuilding for the IPO. The company sold its Checkout payments business for $520 million, acquired New Zealand-based Laybuy, and partnered with big names like Google, Apple, and JPMorgan to expand its buy-now, pay-later options. Klarna now boasts 93 million active users and works with over 675,000 merchants.

But there’s still work to do. Klarna disclosed a “material weakness” in its financial controls tied to its IT systems—an issue the company says it’s working to resolve. It’s also under investigation by Sweden’s Consumer Agency over marketing practices. Not exactly red flags, but not the cleanest runway for a public debut either.

Competitive Landscape: Klarna isn’t stepping into an empty arena. Affirm and Afterpay (now owned by Block) are entrenched in the BNPL space, while PayPal and even big banks like JPMorgan and Citigroup are ramping up their own installment-based products. Klarna’s advantage? Scale and a head start in Europe.

Can Klarna Keep Up the Momentum? Klarna’s IPO will test just how much appetite investors have for fintechs after a rough couple of years for the sector. The company is looking to raise at least $1 billion, but given Klarna’s history of wild swings in valuation, it’s anyone’s guess where the chips will land.

If Klarna sticks the landing, it could signal that the fintech winter is finally thawing. If not—well, at least Klarna users will still have a few months to split that disappointment into four easy payments.

NEWS

Market Movements

📱 Apple’s AI efforts face setbacks: Apple admitted to internal challenges with its AI program, leading to delays in launching key Siri upgrades. Executives acknowledged the technology works correctly only about 70% of the time, and new features may not arrive until iOS 19 next year ($AAPL).

🧠 Meta to use X's algorithm for misinformation: Meta announced its new Community Notes misinformation tool will use the open-source algorithm from Elon Musk’s X. The company plans to modify the system over time and replace third-party fact-checking in the U.S. ($META).

📺 Comcast secures Olympic rights through 2036: Comcast secured a $3B deal with the International Olympic Committee, extending its Olympic media rights through 2036 as the company seeks to boost live sports coverage on Peacock ($CMCSA).

💸 Spending slows across all income levels: Consumer spending is declining across all income levels due to concerns over tariffs, inflation, and recession fears. Retailers like Walmart, McDonald's, and Kohl’s report weaker demand, while Citi data shows a 9.3% drop in luxury spending ($WMT, $MCD, $KSS, $C).

📱 Sonos drops streaming device plans: Sonos has canceled its planned streaming video player, codenamed Pinewood, which was set for a 2025 launch. Interim CEO Tom Conrad is refocusing the company on software improvements ($SONO).

⚠️ FDA recalls acne treatments over benzene: The FDA announced a voluntary recall of some acne treatments from Walgreens, Proactiv, and La Roche-Posay due to elevated levels of benzene, a known carcinogen ($WBA, $OR).

🏋️♂️ CrossFit looks for a buyer: CrossFit is seeking buyers again after years of financial struggles, leadership changes, and declining gym affiliations. Swiss holding company BeSport is a potential buyer.

COMMODITIES

Gold Breaks Through $3,000

Gold just crossed the $3,000 mark for the first time ever, and it’s not just shiny metalheads who are cheering.

The precious metal, known for thriving during market chaos, has been on a tear—rising 27% in 2024 and adding another 14% this year. The latest push came after Trump’s tariff spree sent investors scrambling for a safe place to park their cash. Gold climbed as high as $3,004.94 an ounce on Friday before settling back slightly, marking a historic moment for the commodity.

Tariffs light the fuse

Gold’s breakout comes as Trump’s trade war heats up. After slapping tariffs on China, Canada, and Mexico, Trump recently threatened a 200% tariff on EU wines and champagnes in response to European duties on American whiskey. Investors aren’t waiting to see how it plays out—they’re loading up on gold as a hedge against economic and geopolitical uncertainty.

Since Trump’s election, over 23 million ounces of gold (worth around $70 billion) have poured into U.S. vaults—so much that it’s pushed the U.S. trade deficit to a record high. Central banks have also been piling in. China, India, and Turkey were the biggest buyers in 2024, with central bank purchases hitting 1,045 metric tons—more than double the yearly average from the past decade.

A new playbook

Gold typically struggles when interest rates and the dollar are strong, since higher yields make bonds more attractive. Not this time. Despite a strong dollar and elevated rates, gold’s role as a safe-haven asset is outweighing those headwinds. “Gold is doing its job as a protector against economic chaos,” said Philip Newman of Metals Focus.

What’s next? The rally is defying even the most bullish forecasts. Goldman Sachs recently raised its year-end gold target to $3,100, while Macquarie sees a path to $3,500 by Q3 if trade tensions escalate further. Despite the record, gold is still well below its inflation-adjusted 1980 peak of $3,800.

Investors who missed the boat at $2,500 are now rushing to get in before it climbs even higher. If Trump’s trade war spirals or central banks keep buying, gold’s rally could have more room to run.

Calendar

On The Horizon

Next Week

After a few wild weeks, the market could use a breather — but don’t count on it.

All eyes are on Wednesday when the Federal Open Market Committee (FOMC) wraps up its two-day meeting. No one expects a rate cut — futures are pricing in a 99% chance the Fed stays put — but Jerome Powell’s post-meeting remarks could either soothe jittery investors or send them back into panic mode. A little reassurance wouldn’t hurt.

The spotlight shifts to housing data next week. Monday brings the home builder confidence index, followed by housing starts and building permits on Tuesday, and existing home sales on Thursday, alongside weekly jobless claims. Earnings season is winding down, so unless someone drops a surprise report, it’ll be a quieter stretch on the earnings front.

Earnings:

Wednesday: General Mills ($GIS), Williams Sonoma ($WSM), Five Below ($FIVE), Signet Jewelers ($SIG), and Ollie’s Bargain Outlet ($OLLI).

Thursday: Nike ($NKE), FedEx ($FDX), Micron Technology ($MU), Accenture PLC ($ACN), PDD Holdings ($PDD), Lennar ($LEN), and KinderCare Learning Companies.

Friday: Carnival Corp ($CCL) and Nio ($NIO).

NEWS

The Daily Rundown

🏛️ Judge orders US government to rehire thousands of fired workers: A federal judge ruled that six federal agencies must reinstate probationary employees fired under the Trump administration’s workforce cuts. The judge called the firings a “gimmick” to justify downsizing and said the Office of Personnel Management’s recommendations to rehire the workers were lawful.

👗 Donatella Versace steps down as Chief Creative Officer: Donatella Versace is leaving her role as Versace’s creative head after nearly three decades. She will transition to a brand ambassador role, while Dario Vitale from Miu Miu takes over as Chief Creative Officer. The move comes amid reports that Prada Group is in talks to acquire Versace for €1.5 billion.

🛒 Retailers warn consumers are running out of money: Major US retailers are reporting a sharp decline in spending across all income levels, with even essentials taking a hit. Dollar General’s CEO said many customers can only afford basic necessities, while higher-income shoppers are switching to bargain stores. Apparel spending fell 12% year-over-year, and major airlines like Delta and American cut sales forecasts due to weaker consumer demand.

🇷🇺 Putin signals mixed stance on Ukraine ceasefire: Russian President Vladimir Putin gave conflicting signals on whether he supports the terms of a US-backed Ukraine ceasefire. Putin said he supports “the idea” of a ceasefire but claimed it would allow Ukraine to regroup militarily. Analysts remain skeptical that Russia will agree to the deal, despite Ukraine’s willingness.

📖 Meta blocks promotion of whistleblower book: Meta secured a legal ruling barring Sarah Wynn-Williams from promoting her new memoir, Careless People, which details her experiences as a Facebook executive. The book includes allegations of sexual harassment and questionable business practices at Meta. The company denied the claims and said Wynn-Williams was fired for poor performance.

💰 Trump family reportedly seeking stake in Binance: The Trump family is reportedly negotiating to acquire a stake in the US arm of Binance while former CEO Changpeng Zhao seeks a presidential pardon for money laundering charges. Zhao remains Binance’s largest shareholder, and a Trump-backed deal could help Binance regain full US operations and secure a crypto license in the EU.

🎿 Foreign skiers flock to Japan’s ski resorts: Japan’s ski resorts are seeing record snowfall and a surge in US visitors. Some areas reported 12 feet of snowpack, and bookings for the 2024–2025 season are up 600% compared to last year. A weak yen and cheaper ski costs are making Japan a more attractive destination than US resorts.

🧪 White House withdraws CDC nominee over vaccine views: The White House pulled the nomination of former Congressman Dave Weldon to lead the CDC after backlash over his vaccine-skeptic views. Bipartisan opposition raised concerns about maintaining public trust in vaccines under Weldon’s leadership.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com