- Investinq

- Posts

- 📉 Palantir Stock Slides

📉 Palantir Stock Slides

+ Warren Buffett’s Successor Has Finally Arrived. Meet Greg Abel.

Good afternoon!The southern tip of Texas just added a new dot to the map: Starbase. Residents—most of them SpaceX employees—voted overwhelmingly to incorporate the area as an official city. The freshly minted municipality will be led by SpaceX VP Bobby Peden as mayor and two other SpaceX-linked commissioners, giving Musk’s rocket empire a bit more autonomy in its launch zone.

Starbase covers just 1.6 square miles, but it's already stirring big debates. A pending state bill could hand the new city control over local road and beach closures, ruffling feathers among county officials and beachgoers. Environmental groups aren’t thrilled either, citing past pollution fines and SpaceX’s growing footprint. In classic Musk fashion, the new town already has a Memes Street—and a giant bust of the man himself.

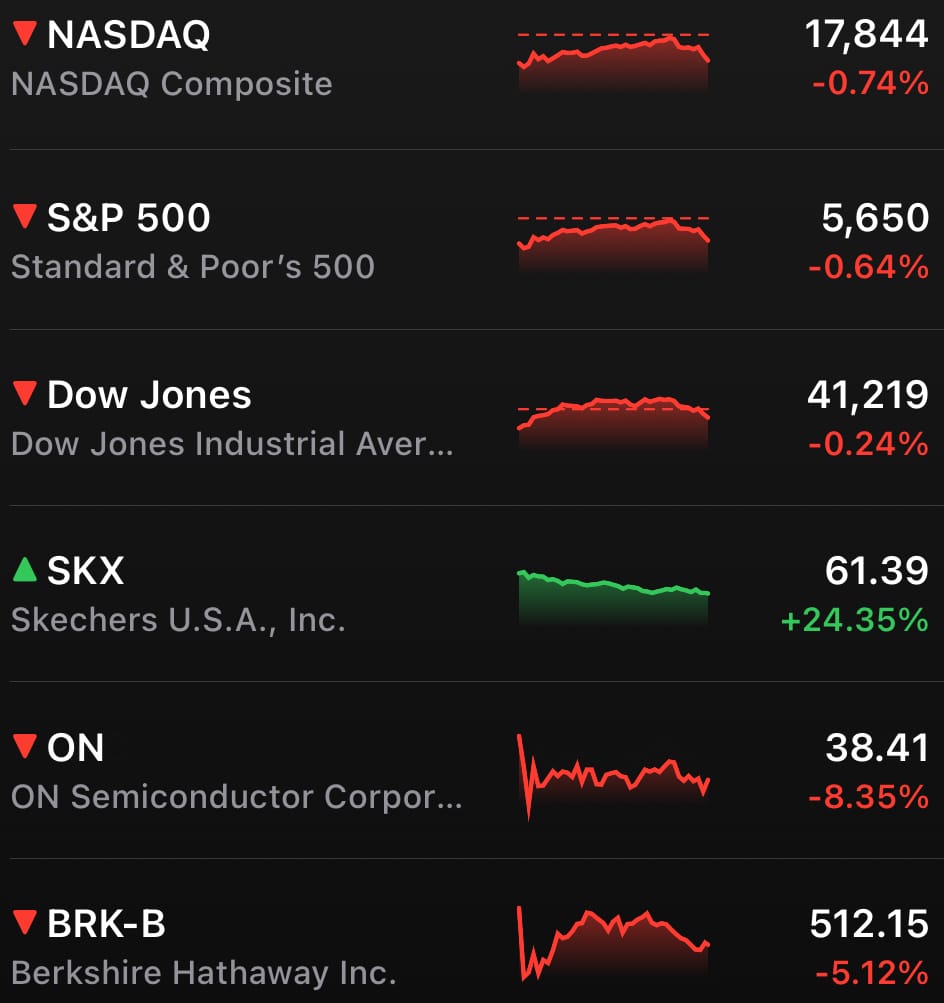

MARKETS

*Stock data as of market close*

After a nine-day sprint, stocks finally hit pause. The S&P 500 slipped 0.6%, snapping its longest winning streak since 2004, while the Dow lost 99 points and the Nasdaq dropped nearly 0.8%. President Trump’s new tariff threats stirred trade war anxieties just as investors were preparing for the Fed’s next move this Wednesday.

Despite some promising economic data and vague trade deal chatter from both Trump and Treasury Secretary Scott Bessent, investors stayed cautious. The market largely expects the Fed to hold steady until June, but rate cut speculation is heating up for July. All eyes now turn to Jerome Powell and to how Canada’s new PM handles his first tariff tango.

Looking for Stability in a Volatile Market?

Private infrastructure has outperformed public market equivalents by 86% on a 10-year annualized basis*—it’s no wonder why wealthy investors choose private markets.

With its highly selective, data-driven investment approach, Hamilton Lane’s Private Infrastructure Fund offers real ownership in the assets that are powering our future:

artificial intelligence

clean energy

logistics + trade

Hamilton Lane provides access to deals from the very best private markets funds in the world, and Class R of this offering has delivered 31.67% annualized performance since inception.*

Add these elite institutional-grade investments to your portfolio today for as little as $500. Learn more about Hamilton Lane Private Infrastructure Fund here.

*Source: Hamilton Lane data, Bloomberg as of January 2024. Past performance is not a guarantee of future returns.

All securities come with specific risks not limited to a total loss of your investment. Past performance is not indicative of future results. Please review the risks specific to this investment on the HLPIF deal page hosted on Republic.com/hlpif

STOCKS

Winners & Losers

What’s up 📈

Skechers exploded 24.35% after the footwear company announced it will be acquired by 3G Capital in a $6.2 billion deal to go private. ($SKX)

Crocs rose 3.38% in sympathy with Skechers’ buyout news. ($CROX)

Deckers climbed 2.88% on the back of acquisition optimism in the footwear space. ($DECK)

Sotera Health jumped 4.36% after Goldman Sachs upgraded the lab testing company to buy, citing a “durable” model that can withstand downturns. ($SHC)

EQT popped 3.22% after UBS upgraded the stock to buy, pointing to strong natural gas tailwinds in 2025. ($EQT)

What’s down 📉

ON Semiconductor dropped 8.35% despite beating on earnings and revenue, as weak guidance spooked investors. ($ON)

Tyson Foods declined 7.75% after revenue missed estimates and the company warned of flat growth ahead. ($TSN)

Berkshire Hathaway fell 5.00% after Warren Buffett announced he will step down as CEO in 2026. ($BRK.B)

Sunoco slid 5.82% following the announcement of its $9B acquisition of Canadian rival Parkland. ($SUN)

Loews slipped 1.76% after first-quarter profits declined in both insurance and hospitality segments. ($L)

Streamers including Netflix, Amazon, Paramount Global, and Warner Bros. Discovery dropped ~2% after President Trump proposed a 100% tariff on non-U.S. movies. ($NFLX, $AMZN, $PARA, $WBD)

EARNINGS

Palantir Stock Slides Despite Strong Earnings. That’s the Price of a Sky-High Valuation.

Palantir just posted a strong quarter. But when your stock is up 64% this year and you’re the most richly valued company in the S&P 500, strong doesn’t always cut it.

Revenue clocked in at $884M for Q1, up 39% YoY and ahead of estimates. The company also raised full-year guidance to ~$3.9B, citing booming demand for its AI software across both government and commercial clients. U.S. commercial sales surged 71% and government revenue jumped 45%. But despite all the glowing metrics, shares dropped ~9% after hours.

Wall Street Wanted a Firestorm, Not a Whirlwind

CEO Alex Karp described the current demand for Palantir’s AI tools as a “ravenous whirlwind,” and said the company’s growth “at this scale... is unparalleled.” That kind of language might have landed better if the stock wasn’t already priced like it’s inventing AI 2.0. At over 200x earnings, even solid beats feel underwhelming.

What Wall Street really saw: a quarter that met expectations, not one that shattered them. Adjusted EPS came in at $0.13—right in line—and while sales exceeded forecasts, the high bar for AI-driven growth meant any sign of moderation would trigger a pullback.

Riding the AI Wave—But for How Long?

Palantir’s bread and butter remains defense and intelligence work, but it’s rapidly expanding into the corporate world. The company signed 139 deals worth $1M+, including 31 topping $10M. It also expects to generate over $1.7B in adjusted operating income this year, along with $1.6–$1.8B in free cash flow.

Still, cracks are showing. With the stock having quadrupled in 2024, investors are no longer just betting on AI—they're demanding it deliver, fast. And while Palantir boasts a 20% operating margin and sky-high government demand, tech's broader downtrend and growing scrutiny over AI hype could cool enthusiasm.

TL;DR: Palantir’s quarter was objectively great. But in this market, “great” doesn’t always translate to “up.” When expectations are sky-high, even a whirlwind can feel like a breeze.

NEWS

Market Movements

🎬 Trump announces 100% tariff on foreign-made films: Netflix, Disney, WBD, and Paramount stocks fell after Trump revealed plans to impose a 100% tariff on non-U.S.-made movies to revive domestic film production. Analysts warn the move may not reverse the offshoring trend ($NFLX, $DIS, $WBD, $PARA).

👟 Skechers jumps on $9.4B go-private deal: Skechers stock soared 25% after announcing a $9.4B acquisition by 3G Capital, which will take the sneaker brand private. The deal comes amid macro uncertainty and tariff exposure, with ~45% of its production in China ($SKX).

📉 Ford suspends 2025 guidance amid $2.5B tariff hit: Ford beat Q1 expectations but pulled its 2025 outlook due to a projected $2.5 billion tariff impact, of which it aims to offset $1 billion. Executives warned of supply chain risks and potential retaliatory tariffs that could further disrupt operations ($F).

💉 Hims & Hers beats Q1 but offers soft guidance: Hims reported strong Q1 earnings, with 111% YoY revenue growth and $91M in adjusted EBITDA, but its Q2 outlook missed expectations. The company teased new partnerships, and short interest remains high amid weight-loss drug demand volatility ($HIMS)

🚗 Tesla slashes Model Y prices amid soft demand: Tesla began offering steep financing discounts and rebates on its revamped Model Y just weeks after launch, signaling weaker-than-expected demand. Experts say this contradicts hopes of pent-up interest for the update ($TSLA).

✈️ United cuts Newark flights after 1,400 disruptions: United Airlines will reduce its Newark schedule by 10% following major flight disruptions tied to FAA staffing shortages, as its CEO calls for traffic caps to manage delays ($UAL).

🏗 Pershing Square boosts Howard Hughes stake to nearly 47%: Bill Ackman’s Pershing Square will invest $900 million to increase its stake in Howard Hughes, aiming to reshape the company into a high-growth holding vehicle ($LON:PSH) ($HHH).

🚗 Volvo reports 11% sales drop, EV sales slump 32%: Volvo Cars said April sales fell 11% year-over-year, with electric vehicle sales down sharply amid tariff impacts and rising competition, contributing to a 29% stock decline in 2025.

CEO

Warren Buffett’s Successor Has Finally Arrived. Meet Greg Abel.

After six decades, $365,000 of returns for every $1 invested, and a cult following that rivals any rock star, Warren Buffett is stepping down. The 94-year-old Oracle of Omaha will hand over the CEO reins of Berkshire Hathaway at the end of 2025. His replacement? A Canadian accountant who likes hockey and built his empire in Des Moines: Greg Abel.

A Billionaire’s Blueprint

Abel isn’t new to the Berkshire machine. He’s been with the company since 2000, helped turn MidAmerican Energy into a multi-billion-dollar operation, and was officially tapped as Buffett’s successor back in 2021. But the announcement still hit like a jolt at Berkshire’s annual shareholder meeting this weekend. Even Abel didn’t seem to see it coming.

He’ll take over one of the world’s most iconic companies—with $1.1 trillion in assets, $348 billion in cash, and a reputation so revered that Buffett’s mere presence could prop up markets in a crisis. The question now: can Abel keep the magic alive?

Not Buffett 2.0—And That’s the Point

Abel is expected to take a “more active” approach than Buffett, who famously let his companies run themselves. At the meeting, Buffett joked Abel would do the job “better,” while also admitting he’d sometimes let bad actors slide, whereas Abel acts.

That’s crucial. Because while Buffett built Berkshire by writing legendary checks during moments of panic, Abel inherits a different challenge: deploying a war chest in a market where private equity and Big Tech often outbid traditional buyers. His biggest job might not be investing—it’ll be managing a sprawling empire of 70+ companies, from GEICO to See’s Candies.

Wall Street’s Mixed Reaction

Berkshire stock fell over 5% after the announcement—investors are clearly nervous. Bloomberg analysts called it the end of an era. But others, like Apple’s Tim Cook and former board members, say Berkshire is in steady hands.

Still, some worry that without Buffett’s brand, shareholders will start asking tougher questions—like why exactly Berkshire is hoarding hundreds of billions in cash. Abel may not be able to ride the same wave of trust Buffett earned over decades of performance and plainspoken charm.

The Takeaway: Warren Buffett isn’t just leaving behind a company. He’s leaving behind a culture, an investing philosophy, and a legacy that might never be replicated. Greg Abel doesn’t have to be Warren. But he does have to prove he knows what to do with the house that Warren built.

And investors are watching.

Calendar

On The Horizon

Tomorrow

Tuesday’s trade deficit report usually flies under the radar—but not this time. With companies racing to import goods ahead of looming tariffs, this month’s numbers could reveal a lot about how the global chessboard is shifting.

A fresh wave of quarterly results is coming in hot. Keep an eye on updates from Arista Networks, Marriott, EA, Datadog, Ferrari, and more as Wall Street continues to digest how corporate America is navigating the current economic storm.

After Market Close:

AMD has lagged hard—down 30% in the past year—while Nvidia keeps climbing. But with solid data center demand and a still-strong product lineup, some investors see a rare discount in the AI hype cycle. Tariffs and capex cuts could sting, though, and only time will tell if this is a hidden gem or a trap in disguise. ($AMD)

Super Micro is down 55% over the past year, as GPU delays and cautious customers slam the brakes on its growth. Bulls say this is just a speed bump, with long-term demand for servers and storage staying strong. Bears say the latest preliminary results tell a clearer story—budget cuts and a weakening bottom line. ($SMCI)

NEWS

The Daily Rundown

🚨 NYC to install panic buttons in bodegas after crime surge: New York City will spend $1.6 million to install emergency panic buttons in 500 bodegas across all boroughs. The devices will link directly to the NYPD, bypassing 911 to ensure quicker responses after several violent attacks on deli workers sparked demands from the United Bodega Association.

🧠 Companies tap neurodivergent talent for innovation edge: More employers are actively recruiting neurodivergent workers, such as those with autism and ADHD, to boost problem-solving and innovation. Programs like SAP’s “Autism at Work” have shown positive results, prompting companies to adapt hiring and workplace practices to be more inclusive of varied thinking styles.

💸 Zelle outage disrupts weekend payments across U.S.: Peer-to-peer payment app Zelle suffered a widespread outage starting Friday, leaving users unable to send or receive money through Saturday. Although most services are back online, lingering issues remain for some. The disruption highlights how deeply integrated digital payments have become in daily life.

🐍 Snake enthusiast’s blood helps create breakthrough antivenom: Tim Friede, who spent decades voluntarily getting bitten by deadly snakes to build immunity, has helped biotech startup Centivax develop an antivenom that protects against 13 of the deadliest snakes. Centivax’s CEO said Friede’s blood provided the antibodies needed to create broad-spectrum protection. If commercialized, the drug could transform the $600M antivenom market.

🎤 Lady Gaga concert breaks world record for attendance: Over 2.5 million people packed Rio de Janeiro’s Copacabana Beach for Lady Gaga’s free show, breaking Madonna’s 2024 record. The city paid for the event to boost tourism, expecting a $100M economic impact. Authorities say they thwarted a bomb plot tied to the concert.

🏇 Sovereignty wins muddy Kentucky Derby in upset finish: Sovereignty outran favorite Journalism on a rain-soaked track to win the 151st Kentucky Derby, clocking in at 2:02.31. The win marks trainer Bill Mott’s second Derby victory and the first ever for Godolphin after 13 attempts. Junior Alvarado rode the 3-year-old colt to victory at Churchill Downs.

🇦🇺 Albanese re-elected, expands Labor Party majority in Australia: Prime Minister Anthony Albanese secured a historic second term, becoming the first Australian leader in over 20 years to win re-election. His Labor Party gained at least 87 seats in the House of Representatives, while opposition leader Peter Dutton lost his own seat in a broad rejection of his Trump-style platform.

📆 Fed meeting, Met Gala, and Trump-Carney summit lead the week: The Fed is expected to hold rates steady amid trade war uncertainty. On Tuesday, Canada’s new PM Mark Carney will meet Trump to discuss tariff relief, though expectations for progress are low. Meanwhile, the Met Gala kicks off tonight with the theme “Tailored for You,” celebrating Black dandyism.

⚖️ Diddy’s federal trial over abuse and trafficking begins today: Jury selection begins in Sean Combs’s trial, where he faces racketeering, sex trafficking, and prostitution charges. One accuser is singer Cassie, who previously dated Combs and was seen being physically assaulted by him in 2016. Combs denies the charges but has admitted to the incident with Cassie.

REFERRAL

Share Investinq 🤝 Acquire Swag

If you love reading our newsletter, don’t be selfish — share it. Odds are your favorite finance bro, trader, investor, or stock market fanatic will too.

Don’t keep all the market news to yourself — share the love using the unique link below.

We deliver you all the news for free every single day (go on… help us out ;)

And here’s the kicker: every referral you make gets you entered into a raffle to win some awesome prizes listed below. Just share the link below and you’ll be entered once they sign up.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com