- Investinq

- Posts

- 💥 Nvidia Smashes Earnings...Again

💥 Nvidia Smashes Earnings...Again

+ US Court Of International Trade Blocks Trump’s Sweeping Tariffs

Good afternoon! Elon Musk’s SpaceX pulled off a bittersweet win last night: Starship hit orbital velocity for the first time before losing control and disintegrating over the Indian Ocean. Still, Musk isn’t slowing down — he’s promised to go “full-time” on his companies again, vowing to accelerate the Starship launch schedule to every few weeks as SpaceX races toward its moon mission.

But over at Tesla, investors are demanding receipts. A coalition of major shareholders just fired off a letter to the board, insisting Musk clock at least 40 hours a week at the EV maker as its sales slip, reputation drops, and stock lags. With Musk’s attention split between Tesla, SpaceX, xAI, and his political ventures, shareholders want stronger oversight, a clear succession plan, and a CEO fully present in the driver’s seat.

MARKETS

*Stock data as of market close*

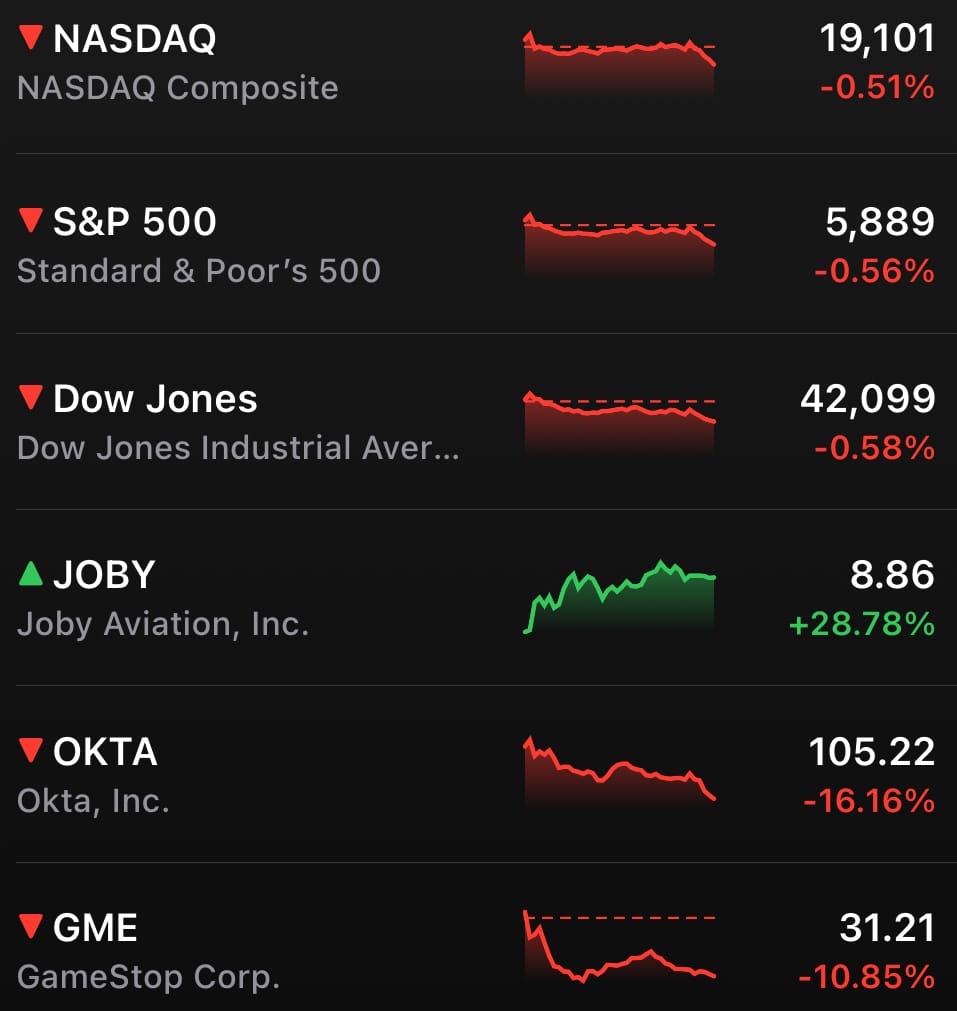

Markets edged lower Wednesday as investors sat tight ahead of Nvidia’s earnings, seen as a key litmus test for Big Tech amid tariff headwinds.

The Dow dipped 0.6%, the S&P 500 slipped 0.5%, and the Nasdaq followed suit, down 0.5%, as Fed minutes flagged lingering inflation risks and Treasury yields briefly topped 5%. All eyes stayed glued to AI King Nvidia, whose report could make or break the markets.

STOCKS

Winners & Losers

What’s up 📈

Joby Aviation soared 28.78% after securing a $250 million investment from Toyota. ($JOBY)

Box jumped 17.23% after beating earnings and raising full-year guidance. ($BOX)

Abercrombie & Fitch climbed 14.67% after beating earnings and revenue despite tariff concerns. ($ANF)

Vail Resorts rose 8.67% after bringing back former CEO Rob Katz. ($MTN)

Capri Holdings gained 2.79% after posting better-than-expected revenue and strong full-year guidance. ($CPRI)

Dick’s Sporting Goods edged up 1.66% on solid earnings and steady fiscal guidance. ($DKS)

What’s down 📉

Okta tumbled 16.16% despite strong earnings, as guidance stayed flat amid macro uncertainty. ($OKTA)

GameStop dropped 10.85% after revealing it bought over $500 million in bitcoin. ($GME)

Cadence Design Systems fell 10.67% after reports of a White House order to stop selling to China. ($CDNS)

Synopsys slipped 9.64% on the same China-related chip sales restrictions. ($SNPS)

Semtech stumbled 4.56% despite beating earnings and raising its fiscal outlook. ($SMTC)

Freshpet fell 3.97% after a downgrade from TD Cowen on growth concerns. ($FRPT)

Stellantis dropped 3.15% after announcing a leadership change. ($STLA)

EARNINGS

Nvidia’s Q1 Earnings Show Business Is Still Booming Despite Being Shut Out of China

Nvidia’s latest earnings? Straight fire. Q1 revenue hit $44.1 billion — up a ridiculous 69% year-over-year — beating Wall Street despite a $2.5 billion hit from U.S. export bans to China. Adjusted EPS landed at $0.81, a bit under consensus, but the real win was gross margins: a juicy 71.3%. Gamers surprisingly pulled the weight here, with gaming sales smashing estimates by 32%, while data center sales — the AI moneymaker — came in just a touch light.

Looking Ahead: Still a Juggernaut

For Q2, Nvidia’s aiming for $45 billion in revenue, even though it’s missing $8 billion from China. Wall Street? Unbothered. Shares popped over 5% in after-hours trading, because the company’s Blackwell chips are selling like hotcakes, and global demand for AI hardware is still exploding. Nvidia’s now worth over $3.3 trillion, second only to Microsoft. Yeah, no one’s feeling sorry for them.

China Who?

CEO Jensen Huang admits China’s a mess — stricter U.S. controls have effectively locked Nvidia out of a $50 billion AI chip market, a painful hit no matter how you slice it. But Huang’s not sitting around sulking. Nvidia’s loading up elsewhere, pulling in big money from sovereign AI projects in the Middle East and riding a spending frenzy from U.S. tech giants like Amazon, Microsoft, and Google, all doubling down on AI infrastructure. Huang even teased that they might cook up a new chip design that cleverly skirts U.S. export bans — though for now, it’s just an idea on the whiteboard, not a product on the shelf.

One Fun Takeaway: For all the talk about Nvidia riding the AI wave, it was good old gaming that quietly saved the quarter. Yep, the same folks hunting virtual zombies and farming loot boxes are helping fund the global AI arms race. Funny how that works — and here’s the kicker: the gaming division’s resilience shows Nvidia still has a core business outside of AI, giving it a safety net if AI demand ever cools or regulatory walls keep rising.

NEWS

Market Movements

🚀 Abercrombie Soars on Record Q1, Cuts Profit Outlook: Abercrombie jumped over 30% after smashing Q1 earnings, though it slashed its full-year profit forecast due to $50 million in expected tariff charges ($ANF).

✈️ Joby Aviation Surges After $250M Toyota Investment: Joby Aviation soared 28% following news of a fresh $250 million investment from Toyota, fueling growth in the electric air taxi space ($JOBY).

🛻 Stellantis Names Jeep Boss as New CEO: Stellantis appointed Antonio Filosa as its new CEO after years of declining U.S. sales, focusing on regaining market share as tariff discounts end ($STLA).

🚨 Trump Pushes Back on ‘TACO Trade’ Label: President Trump rejected claims he “chickens out” on tariffs, saying his shifting plans are part of successful negotiations with the EU and China ($DJT).

💄 E.l.f. Beauty Buys Rhode in $1B Deal: E.l.f. Beauty announced it will acquire Hailey Bieber’s skincare brand Rhode for up to $1 billion, expanding into high-end skincare as tariffs squeeze margins ($ELF).

📉 HP Sinks 15% After Earnings Miss: HP reported better-than-expected revenue but missed earnings and issued weak guidance, blaming added costs from Trump’s new tariffs ($HPQ).

📈 Salesforce Beats Earnings, Raises Forecast: Salesforce topped expectations and raised guidance after announcing its $8 billion acquisition of Informatica to boost AI tools ($CRM).

🤖 Tesla Robotaxi Service Targets June 12 Launch: Tesla is preparing to launch its long-awaited robotaxi service in Austin by June 12, shifting company focus toward autonomy and AI bets ($TSLA).

💰 GameStop Buys $512M in Bitcoin: GameStop purchased 4,710 bitcoins for $512.6 million as part of a new crypto-focused revival strategy, pushing shares up 3% premarket ($GME).

👔 Instacart Names New CEO: Instacart appointed Chris Rogers, a former Apple executive, as CEO following Fidji Simo’s move to OpenAI, with Rogers officially stepping in on August 15 ($CART, $AAPL).

🔧 ASML’s Market Value Sinks: ASML has lost over $130 billion in market value since July 2024 due to U.S. export restrictions and tariff uncertainty, though analysts still project a 17% upside ($ASML).

🧠 Neuralink Raises $600M at $9B Valuation: Neuralink has raised $600 million at a $9 billion valuation as it moves forward with human brain implant trials following recent FDA breakthrough status.

COURTS

US Court Of International Trade Blocks Trump’s Sweeping Tariffs

Markets are rallying in after-hours trading after the U.S. Court of International Trade struck down most of President Trump’s sweeping global tariffs, calling them illegal and beyond presidential authority. Investors, clearly tired of the months-long trade rollercoaster, are cheering the prospect of calmer waters ahead.

A Major Blow to Trump’s Economic Playbook

A three-judge panel ruled Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose broad tariffs was an overreach. While older levies like steel and aluminum tariffs stay put, Trump’s global flat tariffs, his retaliatory “reciprocal” duties, and his fentanyl-related tariffs on China, Canada, and Mexico are now blocked. The White House says it will appeal — possibly all the way to the Supreme Court but for now, the court’s decision puts a sharp check on one of Trump’s signature economic moves.

Markets Exhale, Diplomacy Scrambles: Investors had been bracing for months of tariff-fueled volatility, but the court’s move gives them a reprieve — at least for now. Stocks tied to global supply chains popped in after-hours trading as Wall Street bet on a cooling of the trade tensions that have battered everything from manufacturing to tech. But while markets breathe easier, global diplomats are left scrambling: the ruling throws a wrench into ongoing negotiations with China, Europe, and beyond, as the legal footing for Trump’s tariff pressure suddenly crumbles.

What’s Next? The ruling opens up big questions about how future administrations — not just Trump’s — can wield trade powers without Congress. If the court’s decision holds, presidents may lose one of their biggest economic pressure tools, reshaping how the U.S. negotiates on the global stage. For companies, it’s a temporary breather but it also signals that the era of executive-driven trade wars may be heading toward a more legally constrained future.

Calendar

On The Horizon

Tomorrow

Thursday’s shaping up to be a data-heavy day, with initial jobless claims, pending home sales, and — the big one — a fresh look at Q1 GDP. Everyone from Wall Street to Washington will be watching to see if the economy really stumbled as badly last quarter or if the first estimates painted too bleak a picture.

On the earnings stage, get ready for a flood of updates from heavyweights like Costco, Best Buy, Dell, Marvell Technology, Zscaler, Li Auto, Ulta Beauty, The Gap, Bath & Body Works, Burlington Stores, and Cracker Barrel. Expect plenty of post-call chatter as analysts sift through who’s holding up under the weight of tariffs and shifting consumer trends.

Trusted by 1,000,000+ readers across the world and political spectrum

Ground News lets you compare how left, center, and right-leaning outlets cover the same story, so you can easily analyze reporting and gain a well-rounded perspective on the issues that matter to you.

Built for the age of the algorithm, its Blindspot Feed shows stories underreported by the left or right, helping you break out of your bubble and challenge your worldview. Because the news you don’t see can shape your perception just as much as what you do see.

Find out why the Nobel Peace Center endorsed Ground News as “an excellent way to stay informed, avoid echo chambers, and expand your worldview.”

NEWS

The Daily Rundown

💉 GLP-1 Drug Use Soars Among Americans: About 4% of U.S. adults now take GLP-1 drugs like Ozempic or Mounjaro, up nearly 600% since 2019. Half use them for weight loss, while the other half rely on them for diabetes management. Researchers expect demand to keep growing as new health benefits emerge.

⚕️ RFK Jr. Ends COVID Vaccine Recommendations for Kids: Health Secretary Robert F. Kennedy Jr. announced COVID vaccines are no longer recommended for healthy children and pregnant women. The decision bypassed normal advisory panels and sparked backlash from public health experts. The CDC’s website still advises vaccinations for everyone 6 months and older.

📜 Texas Mandates Ten Commandments in Classrooms: Texas lawmakers passed a bill requiring public schools to display the Ten Commandments in every classroom. Supporters argue it reinforces moral values, while critics warn it violates the separation of church and state. The controversial measure is expected to face legal challenges.

🤖 Salesforce Makes $8B AI Acquisition: Salesforce announced its $8 billion purchase of Informatica to boost its data management and AI capabilities. It’s Salesforce’s biggest deal since acquiring Slack in 2021, aiming to enhance its AI agents with Informatica’s data catalog. Talks had fallen apart last year, but a lower Informatica share price helped revive the deal.

🚀 Elon Musk Wants to Refocus on Business: E Musk is stepping back from government roles to focus on shoring up Tesla, X, and Neuralink, especially as Tesla’s European sales just dropped 49%. lon Musk oversaw SpaceX’s ninth Starship launch, which flew farther than past tests but still ended in fiery failure. The test was key for Musk’s plan to send Starship to Mars by next year and eventually land humans by 2029.

🏒 IOC Upholds Ban on Russian Teams for 2026 Olympics: The International Olympic Committee confirmed Russian teams will remain banned from the 2026 Winter Olympics due to ongoing Ukraine-related sanctions. While individual Russian athletes may compete under a neutral flag, team sports like ice hockey are excluded.

🏫 Trump Plans to Sever Federal Ties to Harvard: The Trump administration is moving to cut $100 million in remaining federal contracts with Harvard, following previous grant freezes. The administration accuses Harvard of mishandling antisemitism on campus and aims for a “complete severance.” A federal judge has temporarily blocked a related attempt to stop Harvard from enrolling international students.

📈 U.S. Consumer Confidence Rebounds in May: After five straight months of decline, U.S. consumer confidence jumped by 12.3 points to 98.0 in May. Analysts credit the rebound to easing trade tensions and paused tariffs. Still, worries about inflation and long-term economic stability remain.

🎙 NPR Sues Trump Administration Over Funding Cuts: NPR and three Colorado affiliates are suing the Trump administration over an executive order cutting public media funding, arguing it violates the First Amendment. NPR claims Trump’s decision is unconstitutional retaliation against critical coverage. Though NPR only gets 1% of its budget from federal funds, local stations provide 10% through licensing.

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors couldn’t join until then, missing early gains. So he did things differently with Pacaso. They’ve made $110M+ in gross profits disrupting a $1.3T market. And after reserving the Nasdaq ticker PCSO, you can join for $2.80/share until 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

REFERRAL

Share Investinq 🤝 Acquire Swag

If you love reading our newsletter, don’t be selfish — share it. Odds are your favorite finance bro, trader, investor, or stock market fanatic will too.

Don’t keep all the market news to yourself — share the love using the unique link below.

We deliver you all the news for free every single day (go on… help us out ;)

And here’s the kicker: every referral you make gets you entered into a raffle to win some awesome prizes listed below. Just share the link below and you’ll be entered once they sign up.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com