- Investinq

- Posts

- 😎 Meta Oakley AI Glassess

😎 Meta Oakley AI Glassess

+ The Lakers Just Pulled Off the Greatest Trade Ever

Good afternoon! Sam Altman threw some serious shade at Meta on his brother’s podcast, revealing that OpenAI researchers have turned down $100 million signing bonuses from Zuckerberg’s new superintelligence team. Altman said none of his top people took the bait despite the “crazy” offers because they believe in OpenAI’s mission and culture. He didn’t hold back either, saying Meta just isn’t great at innovation and that a fat paycheck isn’t enough to build a truly groundbreaking AI lab.

While Meta has snagged a few names from DeepMind and Sesame AI, it’s still struggling to lure top-tier talent from the biggest players. Altman argued that Meta’s strategy lacks the vision needed to create AGI

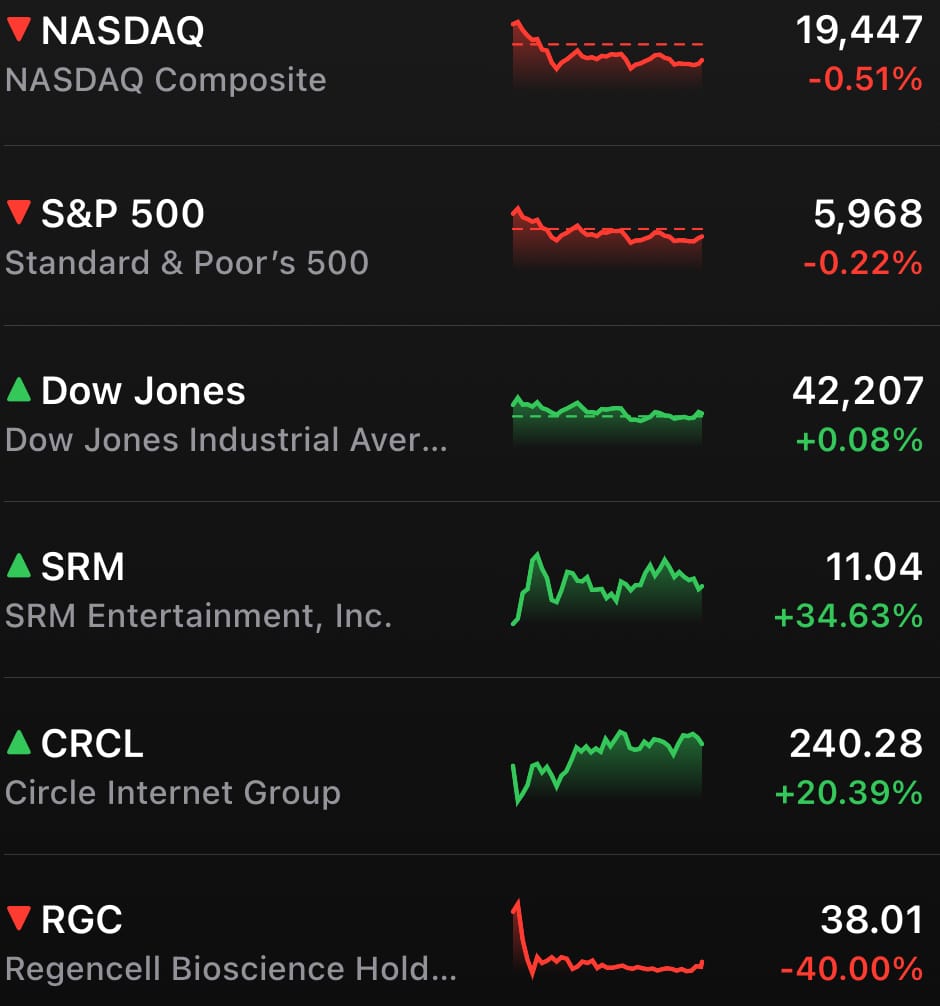

MARKETS

*Stock data as of market close*

Markets opened strong Friday after Fed Governor Waller suggested a rate cut could come as early as July. But the gains didn’t last—tensions in the Middle East and uncertainty over future Fed moves weighed on sentiment.

By the close, the S&P dipped 0.2%, and the Nasdaq fell 0.5%, while the Dow inched up 0.1%. For the week, all three indexes barely budged, with the Nasdaq up 0.2% and the S&P down 0.2%.

Hands Down Some Of The Best 0% Interest Credit Cards

Pay no interest until nearly 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

STOCKS

Winners & Losers

What’s up 📈

SRM Entertainment soared 34.63% as the former toy company rode a wave of retail investor excitement after transitioning into a crypto stock. ($SRM)

GMS surged 23.77% after a bidding war emerged between QXO and Home Depot to acquire the building materials maker. ($GMS)

Circle climbed 20.39% as the Senate’s passage of the GENIUS Act continued to drive gains in stablecoin-related companies. ($CRCL)

GXO Logistics rose 12.13% after raising its full-year EBITDA outlook and naming a new CEO. ($GXO)

Kroger jumped 9.84% after beating Q1 earnings expectations and reaffirming its full-year guidance. ($KR)

CarMax gained 6.59% on stronger-than-expected earnings driven by a 9% increase in used car sales. ($KMX)

What’s down 📉

Regencell Bioscience plummeted 40.00% as its post-stock-split rally continued to unravel. ($RGCL)

Accenture dropped 6.86% after reporting a 6% drop in bookings, despite beating on Q3 earnings. ($ACN)

KLA fell 2.43% and Marvell Technology dropped 1.92% as chip stocks declined following reports the U.S. may revoke China-related export waivers. ($KLAC, $MRVL)

TSMC lost 1.87% and Nvidia slid 1.12% as broader semiconductor concerns weighed on the sector. ($TSM, $NVDA)

Jack in the Box dipped 1.11% after a downgrade from Stifel, citing policy headwinds. ($JACK)

Mastercard and Visa declined 1.07% and 0.53% respectively amid reports that X may launch its own physical payment card. ($MA, $V)

TECH

Meta introduces Oakley AI smart glasses that start at $399

Meta’s stepping out of the sun-soaked shadow of Ray-Ban with a new partner: Oakley. The tech giant just dropped its latest smart glasses lineup starting at $399, designed for athletes and adrenaline junkies who want to record 3K video without strapping a GoPro to their foreheads. The limited-edition $499 HSTN (pronounced “how-stuhn”) model features gold accents, 8-hour battery life, and enough AI to tell you what you’re looking at or at least try to.

Battery Boost & AI Banter

These sporty specs pack double the battery life of Meta’s Ray-Bans, plus water resistance (IPX4), open-ear audio, and a voice assistant that can supposedly ID what you’re seeing. Think: “Hey Meta, what’s that bird?” just don’t expect a David Attenborough-level answer. The real win? A charging case with up to 48 hours of juice and a camera that shoots in crisp 3K, perfect for skiers, cyclists, or anyone with a thirst for content and a fear of commitment to a full camera rig.

A Performance Play: Meta says this is just the beginning. With a multi-year roadmap ahead and plans for a cyclist-focused follow-up, the company’s leaning hard into the “performance” category. Oakley is just the first of many EssilorLuxottica brands Meta plans to team up with, aiming to hit 10 million unit sales a year by 2026. If they can keep up the momentum (and keep battery complaints to a minimum), the future of smart eyewear might just look... smart.

Bottom Line: With Meta going full throttle into sporty smart glasses, GoPro might want to start sweating. This isn’t just about eyewear—it’s about grabbing a piece of the wearable AI hardware race. And if the Ray-Ban success was a surprise, Meta’s hoping Oakley helps them turn that into a trend.

NEWS

Market Movements

🚀 SpaceX Explosion Boosts Rivals: Another SpaceX rocket blew up during testing in Texas late Thursday—no injuries reported, but investors took note. Shares of rivals Rocket Lab ($RKLB) and AST SpaceMobile ($ASTS) jumped 7.9% and 3.6% respectively on Friday. CEO Elon Musk also caused a stir with a brief threat to scrap SpaceX’s Dragon capsule in a public spat with President Trump, amplifying concerns over U.S. reliance on his launch monopoly.

📊 Goldman’s Risk-Reward Favorites: Goldman Sachs updated its list of stocks with the best risk-adjusted return outlook using “prospective Sharpe ratios.” LKQ Corp. ($LKQ) topped the list, followed by underdogs like Omnicom ($OMC), Viatris ($VTRS), and Moderna ($MRNA)—each battered but potentially undervalued.

💊 Oscar Health Becomes a Retail Darling: Oscar Health ($OSCR) surged nearly 60% this week on no news and plenty of retail trader hype. With strong revenue growth, AI-powered marketing talk, and a viral run on WallStreetBets, Oscar is suddenly 2025’s newest meme stock.

🚗 CarMax Rides Demand to Beat Earnings: CarMax ($KMX) posted stronger-than-expected earnings with a 38% profit jump and 230,000 used vehicle sales. With tariffs squeezing new car buyers, the used market is heating up—and CarMax is beating rivals like Carvana at their own game.

🇨🇳 U.S. May Revoke Chip Waivers to China: Semiconductor stocks dropped after reports the U.S. may cancel waivers allowing Samsung, SK Hynix, and TSMC to send American chip tech to China. The move would tighten export controls amid fragile U.S.–China trade relations ($TSM).

🔋 Tesla to Build China’s Largest Battery Plant: Tesla inked a $556M deal to build China’s largest grid-scale battery storage facility in Shanghai. The project underscores China’s growing demand for energy storage and Tesla’s ambitions beyond EVs ($TSLA).

🧠 Meta Tried to Buy Perplexity Before Scale AI Deal: Meta approached AI startup Perplexity about an acquisition before investing $14.3B in Scale AI. The failed deal shows how aggressively Meta is pushing to catch up with OpenAI and Google ($META).

💰 JPMorgan Adds Bond Trading to Mobile App: JPMorgan will now let users buy bonds and CDs directly through its app. It’s part of a broader push to compete with giants like Schwab and grow its self-directed investing business to $1 trillion ($JPM).

🚀 Circle Surges 500% on Stablecoin Bill: Circle shares are up nearly 50% this week and over 500% since its IPO after the Senate passed a landmark stablecoin bill. Shares rose 14% premarket. ($CRCL)

🤖 SoftBank Proposes $1T AI Complex in Arizona: Masayoshi Son is pitching a $1 trillion AI and robotics park in Arizona, seeking TSMC partnerships and U.S. government support. ($TSM)

💾 Texas Instruments to Invest $60B in Chip Production: The investment will expand domestic capacity and create 60,000 jobs across Texas and Utah, as U.S.-China chip tensions grow. ($TXN)

💸 X to Roll Out Trading Tools and X Money Wallet: Elon Musk’s X will launch investment features and a digital wallet in the U.S., with plans for a branded debit or credit card. (No ticker)

🏗️ Home Depot Enters Bidding War for GMS: Home Depot is competing with QXO to acquire building distributor GMS, which just received a $5B offer. GMS shares jumped 10.6%. ($HD, $QXO, $GMS)

SPORTS

Buss family to sell majority stake in Lakers to Mark Walter for $10B valuation

In 1979, the Buss family bought the Lakers for $67.5 million. This week, they sold a majority stake to billionaire Mark Walter at a $10 billion valuation — a 14,700% return and arguably the best trade in NBA history (sorry Luka & Anthony Davis).

The price tag didn’t just break records, it torched them. The Lakers are now officially the most valuable sports franchise on Earth, leapfrogging the Celtics, Cowboys, and every Saudi-funded soccer club in sight.

Mark Walter, CEO of Guggenheim Partners and already owner of the Dodgers, Sparks (WNBA), and Chelsea FC is now officially the czar of Los Angeles sports. He already owned ~27% of the Lakers since 2021, but this deal takes him over the top. Jeanie Buss stays on as team governor (for now), thanks to the NBA’s 15% rule but she’s no longer in the driver’s seat.

Why Drop $10B on a Team That Doesn't Print Money? Here’s the twist: The Lakers aren’t some cash cow. They bring in ~$500 million a year. For comparison, private equity firm 3G just bought Skechers for the same price, and they have 20,000 employees and $9B in sales.

So why would Walter pay 20x revenue for a team that sells jerseys and vibes? Because owning the Lakers isn’t just about balance sheets—it’s about owning attention. The Lakers aren’t a basketball team. They’re a luxury media brand with 11 titles, courtside Jack Nicholson, and 40 years of cultural monopoly.

Walter also knows how to squeeze value from legacy assets. He bought the Dodgers in 2012 for $2.15B, people laughed… until he flipped a cable deal into an $8.3B revenue stream. Today, the Dodgers are worth $7.7B. He’s probably eyeing a similar Laker-level play with the NBA’s $77B media deal rolling out later this year.

The Empire Play: With the Dodgers and Lakers under his belt, Walter now controls the two most-watched teams in America’s second-largest media market. He’s not just buying banners—he’s buying bundling power. Think Yankees-YES Network, but LA-style: palm trees, F1 engines, and $700M Shohei Ohtani contracts.

And unlike the Buss family—who famously pinched pennies over free agents—Walter has Abu Dhabi money behind him. His firm TWG Global just raised $10B (yes, the same number) from Mubadala Capital. Don’t be surprised if he turns the Lakers into a content machine, a streaming anchor, or a private equity-backed merchandising monster.

The Bottom Line: Walter’s not trying to run a basketball team, he’s building a dynasty fund. And with the Celtics now worth $6B and Steve Ballmer’s Clippers building a luxury spaceship across town, $10B might end up looking like a steal.

Because when it comes to LA sports, Mark Walter doesn’t just want to win the game, he wants to own the league.

Calendar

On The Horizon

Next Week

Next week’s calendar is stacked with housing and economic data that could shake things up. Kicking off Monday are flash PMIs and a check-in on existing home sales.

Tuesday drops fresh consumer confidence numbers and the S&P Case-Shiller home price index, while Wednesday slows down with just new home sales. But Thursday hits hard with jobless claims, durable goods, GDP revisions, trade numbers, and pending sales all landing at once.

Friday ends on a high-stakes note with the PCE report, the Fed’s go-to inflation gauge. Oddly enough, a handful of straggler earnings reports will also trickle in, keeping the season alive just a little longer.

Earnings:

Monday features reports from FactSet and KB Home.

Tuesday brings FedEx, BlackBerry, and Carnival Corp.

On Wednesday, keep an eye on General Mills, Micron Technology, and Paychex.

And Thursday wraps things up with Nike, Walgreens Boots Alliance, and McCormick & Co.

NEWS

The Daily Rundown

🇹🇭 Thai PM Under Fire Over Leaked Call: Thailand’s Prime Minister Paetongtarn Shinawatra is facing calls to resign after a leaked call with Cambodian leader Hun Sen revealed her deferring to him and criticizing Thai military officials. The scandal has fractured her coalition and prompted national backlash. She apologized and framed the call as informal, while Thailand condemned Cambodia for releasing the audio.

✈️ Airbus Outshines Boeing at Paris Air Show: Airbus secured $21 billion in new aircraft orders (244 jets) during the 2025 Paris Air Show, while Boeing failed to announce any major deals amid safety concerns linked to a recent Air India crash. The contrast highlights Airbus’s market dominance and Boeing’s continued reputational struggles.

🚀 Honda Successfully Tests Reusable Rocket in Japan: Honda’s R&D team launched and landed a reusable rocket in Taiki, Japan on June 17. The 6.3-meter vehicle reached 271 meters and landed within 37 cm of its target, marking a key milestone in Honda’s goal of achieving suborbital flight by 2029. Commercial launch plans are still in early development.

🧀 Listeria Outbreak Linked to Chicken Alfredo Kills Three: A deadly listeria outbreak tied to FreshRealm-made chicken fettuccine alfredo—sold at Walmart and Kroger—has killed three and sickened at least 17 across 13+ states. The CDC and FDA are urging consumers to discard recalled products marked with specific establishment codes.

✈️ Pan Am Returns (Kind of): The iconic airline brand has been revived for a luxury 12-day charter tour across the Atlantic, featuring vintage service and retro aesthetics. While not a full-fledged airline yet, the Pan Am revival hints at future plans including hotels, themed events, and possibly scheduled flights.

📺 Netflix Doc Sparks 400% Raise for Cowboys Cheerleaders: Following the Netflix series America’s Sweethearts, Dallas Cowboys cheerleaders secured a 4x pay raise—up from $15/hour to as much as $75/hour. The show helped spotlight pay inequities for NFL cheer squads and ignited league-wide conversations about compensation.

🌪️ Hurricane Erick Makes Historic Landfall in Southern Mexico: Hurricane Erick struck Mexico’s Pacific coast near Oaxaca on June 19 as a Category 3 with 125 mph winds, tying the record for earliest major-hurricane landfall in the country. Torrential rains caused flash floods and landslides, resulting in at least one death and power outages across Guerrero and Oaxaca. Recovery efforts are ongoing as officials assess widespread damage.

REFERRAL

Share Investinq 🤝 Acquire Swag

If you love reading our newsletter, don’t be selfish — share it. Odds are your favorite finance bro, trader, investor, or stock market fanatic will too.

Don’t keep all the market news to yourself — share the love using the unique link below.

We deliver you all the news for free every single day (go on… help us out ;)

And here’s the kicker: every referral you make gets you entered into a raffle to win some awesome prizes listed below. Just share the link below and you’ll be entered once they sign up.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com