- Investinq

- Posts

- 😲 American Eagle And Sydney Sweeney?

😲 American Eagle And Sydney Sweeney?

+ ServiceNow Surges on Strong Q2 Earnings and AI Demand, Raises Full-Year Outlook

Good afternoon! Amazon is making a bold return to wearables with its acquisition of Bee, a startup behind an AI-powered bracelet that transcribes conversations and turns them into searchable, actionable data. Bee CEO Maria Zollo announced the move in a LinkedIn post, calling it a step toward delivering personal agentic AI at scale. The device doesn’t store audio, only transcriptions, and Amazon says existing privacy controls will apply.

This isn’t Amazon’s first foray into wearables. It launched the Halo band in 2020 before quietly ending support in 2023. But the AI boom has reshaped the landscape, and Bee gives Amazon a fresh angle to compete with smart gadgets from Meta, Google, and Samsung. The race to dominate your daily habits is moving from the cloud to your wrist.

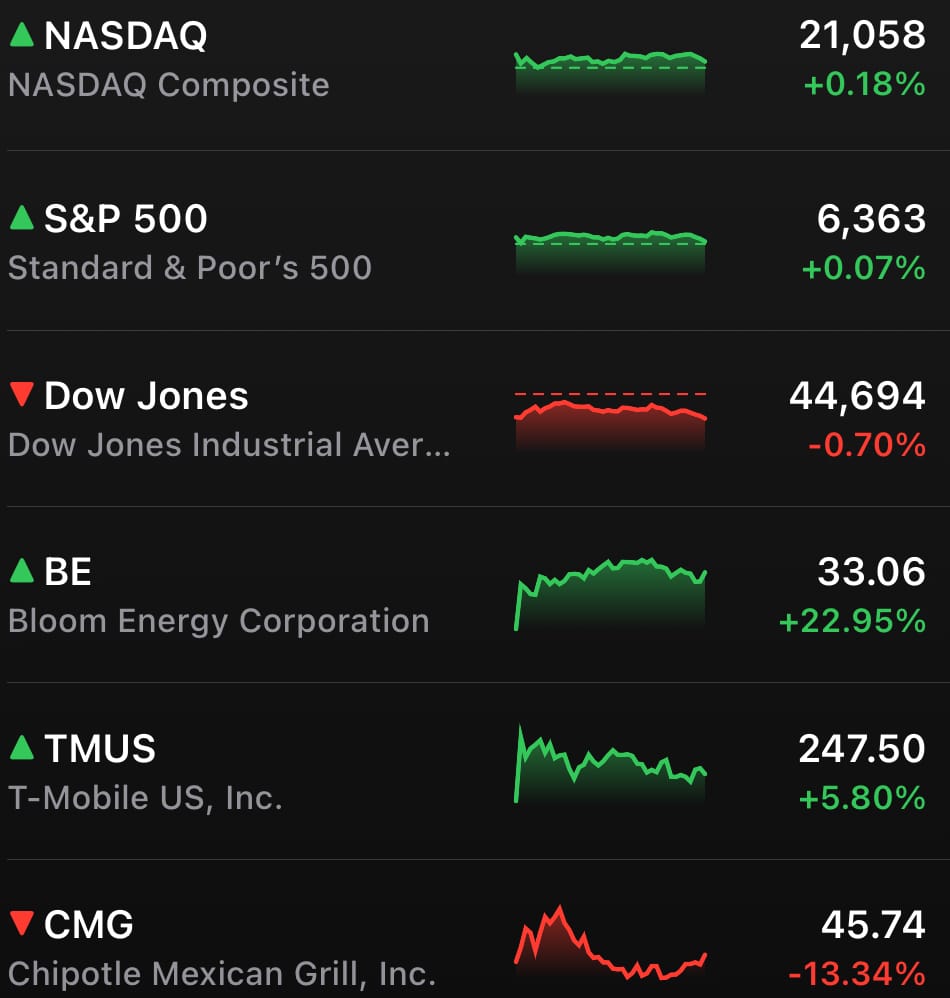

MARKETS

Alphabet’s strong earnings helped push the Nasdaq and S&P 500 to new closing records, with solid labor data adding fuel to the fire. Meanwhile, President Trump’s surprise visit to the Fed the first by a sitting president in nearly 20 years added a dose of political drama to the day.

Tesla met Q2 expectations but still saw earnings fall 23% and revenue drop 12%. Musk stayed bullish on robotaxis and robots, but warned of “a few rough quarters” ahead as EV incentives fade nudging TSLA slightly lower after hours.

STOCKS

Winners & Losers

What’s up 📈

Bloom Energy surged 22.95% after striking a deal with Oracle to power its AI data centers using fuel cell tech. ($BE)

West Pharmaceutical Services soared 22.78% after raising its profit forecast, saying tariff impacts would be milder than expected and GLP-1 product demand remains strong. ($WST)

Deutsche Bank climbed 7.83% to a 10-year high as investors applauded the bank’s turnaround momentum. ($DB)

T-Mobile US gained 5.8% after beating Q2 earnings and revenue estimates. ($TMUS)

ServiceNow rose 4.16% after management raised full-year guidance for subscription revenue and touted strong AI-driven growth. ($NOW)

Las Vegas Sands added 4.31% after crushing Q2 earnings, posting stronger-than-expected revenue and profits. ($LVS)

What’s down 📉

Molina Healthcare tumbled 16.8% after Q2 earnings missed expectations, with adjusted EPS falling short of analyst targets. ($MOH)

Dow Inc. plunged 17.45% after posting a wider-than-expected loss in Q2 and missing revenue estimates. ($DOW)

Chipotle sank 13.34% after cutting its same-store sales forecast and missing Q2 revenue expectations. ($CMG)

IBM lost 7.62% even after a beat on earnings, as investors reacted to management’s warning about slowing software demand. ($IBM)

Tesla fell 8.20% after missing both revenue and EPS expectations in Q2. ($TSLA)

American Airlines dropped 9.6% after slashing its Q3 profit forecast and projecting an adjusted loss up to 60 cents per share. ($AAL)

Southwest Airlines lost 11.16% after missing earnings expectations and disappointing investors with guidance. ($LUV)

Honeywell slid 6.18% despite beating Q2 earnings and raising guidance, as investors reacted cautiously to forward-looking statements. ($HON)

UnitedHealth Group declined 4.76% following reports of DOJ involvement in a Medicare billing investigation. ($UNH)

LVMH slipped 3.94% after posting a 4% sales decline in Q2, with the luxury sector under pressure from global tariffs. ($LVMUY)

Union Pacific dropped 4.54% after confirming it's in talks to acquire Norfolk Southern, which also dipped 0.81%. ($UNP, $NSC)

RETAIL

American Eagle Stock Rises on Sydney Sweeney Launch

American Eagle’s latest marketing move casting Sydney Sweeney in its “Great Jeans” campaign sent the stock soaring nearly 19% in premarket trading before settling up 4.25% by Thursday’s close. The campaign, which leans heavily into Gen Z denim nostalgia, launches ahead of back-to-school season with over 800 new fall styles, including a limited-edition Sweeney-inspired denim set. Investors didn’t just see a model they saw a meme stock.

More Than Just an Ad: Sweeney’s charm, paired with the brand’s AI try-on tech and 3D billboards (including on the Las Vegas Sphere), was enough to stir up serious buzz. Stocktwits sentiment turned “extremely bullish,” and r/WallStreetBets began pumping up $AEO. The retailer saw more than 32,000 call options traded well above its daily average suggesting meme-fueled momentum was in full swing. Analysts say the partnership might help American Eagle crawl out of a tough year, after pulling guidance in May and watching its stock plunge 32% year-to-date.

The Meme Stock Playbook

This isn’t Sweeney’s first time moving markets. Her campaigns with Crocs and Dr. Squatch both led to product sellouts and now, she’s helping American Eagle become the next Levi’s-Beyoncé moment. Add in 13% short interest and it’s easy to see why Reddit traders are circling. Just like GoPro, Krispy Kreme, and Kohl’s earlier this week, American Eagle fits the meme formula: nostalgic brand, struggling fundamentals, and a fresh injection of celebrity buzz.

Retail Traders Reloading

The meme stock crowd is back. With the S&P 500 and Nasdaq hitting all-time highs, retail traders are once again chasing the next short squeeze. Names like Hims & Hers, Etsy, and Rivian are floating to the top of watchlists. But for now, American Eagle is soaking up the spotlight, fueled by a campaign that's as much about denim as it is about dopamine.

Bottom Line: It’s unclear how long the Sweeney surge will last, but in a market this meme-prone, sometimes great jeans are all it takes.

NEWS

Market Movements

⚡ S&P 500 Notches Record Close Despite Tesla Drag: The S&P 500 and Nasdaq 100 hit new closing highs, even as Tesla’s drop weighed on consumer discretionary. Gains were driven by energy, tech, and healthcare, while small caps lagged ($SPY, $QQQ).

🚨 Tesla Flags ‘Rough Quarters’ Ahead as Autonomy Delays and Incentive Loss Bite: Elon Musk warned of a “weird transition period” ahead, citing shrinking deliveries, regulatory setbacks, and the looming expiration of the $7,500 EV tax credit. Tesla’s stock slid over 8% as investors reacted to the cautious tone and declining auto revenue for a second straight quarter ($TSLA).

💊 West Pharmaceutical Soars on Weight-Loss Drug Demand: West crushed Q2 estimates thanks to explosive demand for its GLP-1 injection pen components tied to drugs from Novo Nordisk and Eli Lilly. Shares surged 23% in their best trading day ever as sales from the niche product line took off ($WST).

📉 Intel Sinks on Deeper Loss Despite Optimistic Forecast: Intel posted a sixth straight quarterly loss, but beat on revenue and issued stronger-than-expected Q3 guidance. The company also scrapped European manufacturing plans as part of a shift to more disciplined spending ($INTC).

📶 T-Mobile Pops on Subscriber Gains and Upbeat Guidance: T-Mobile added 1.7 million postpaid subscribers in Q2 and raised its full-year forecast across all key metrics. Shares jumped 6% as it outpaced rivals like AT&T and Verizon ($TMUS).

📉 Southwest Plunges After Weak Quarter Despite $350M Bag Fee Windfall: Southwest’s earnings missed expectations as it admitted it was wrong about bag fees hurting demand—now projecting $1B annualized in fee revenue. Still, shares dropped 11% as demand softened and checked bag volume declined ($LUV).

🚂 Union Pacific and Norfolk Southern Confirm Merger Talks: The two rail giants officially acknowledged ongoing merger discussions to form a cross-country freight titan. Union Pacific fell 4.5%, while Norfolk Southern edged down less than 1% on the confirmation ($UNP, $NSC).

🧸 Mattel Slides After Mixed Results and Weak Barbie Sales: Mattel beat on earnings but missed on revenue as its dolls segment, including Barbie, dropped 19% year-over-year. Shares sank 16% despite strength in Hot Wheels and building sets ($MAT).

📉 IBM Falls as Software Growth Misses the Mark: IBM beat on earnings but reported softer-than-expected growth in its crucial software unit. Shares slipped 8% as investors focused on the underwhelming segment performance despite a strong overall quarter ($IBM).

🧬 Artificial Intelligence and Ethics Clash in Washington’s Plan: The Trump administration’s “AI Action Plan” aims to accelerate adoption while sidelining state regulation, even considering withholding federal funds from stricter states. The sweeping vision promotes chip building, rapid retraining, and federal use of AI—but critics warn it overlooks real risks ($NVDA, $META).

🛫 UnitedHealth Drops After DOJ Medicare Inquiry: UnitedHealth shares fell nearly 5% after revealing it’s responding to a Justice Department request about its Medicare Advantage practices. The disclosure spooked investors already watching the regulatory spotlight on the healthcare giant ($UNH).

🎭 NFL in Talks to Sell 10% Stake in ESPN: Disney is exploring selling a minority stake in ESPN to the NFL, a rare potential move that could reshape how sports rights and content are distributed. A deal would bring in a key strategic partner for Disney as ESPN navigates cord-cutting and streaming shifts ($DIS).

☁️ Google Inks $1B Cloud Deal with ServiceNow: Alphabet signed a deal worth more than $1 billion to provide cloud services to ServiceNow. The agreement deepens ties between two major enterprise software players and may help both compete with Microsoft ($GOOGL, $NOW).

EARNINGS

ServiceNow Surges on Strong Q2 Earnings and AI Demand, Raises Full-Year Outlook

ServiceNow is cashing in on the AI boom. The enterprise software company crushed Q2 expectations and upped its revenue guidance, thanks to surging demand for its generative AI tools. Adjusted earnings came in at $4.09 per share, well above the $3.57 estimate, while revenue hit $3.22 billion, beating projections by $100 million.

Now Assist, Big Assist

The star of the show was Now Assist, ServiceNow’s generative AI product that helped drive a 23% jump in subscription revenue to $3.11 billion. CFO Gina Mastantuono said deal sizes and volumes for Now Assist surpassed expectations, thanks in part to its premium pricing. CEO Bill McDermott added that AI is cutting labor costs and streamlining soul-crushing jobs especially in IT and customer support.

Cloudy With a Chance of Government Cuts

One wrinkle: the U.S. federal government, which accounts for 11% of ServiceNow’s revenue, is in budget shuffle mode. The company warned that federal cost-cutting could put some pressure on growth, especially with more contract renewals pushed to Q4. Still, remaining performance obligations—a gauge of near-term sales—rose to nearly $10.92 billion, topping forecasts.

Full-Year Guidance Upgraded

ServiceNow now expects full-year subscription revenue to reach between $12.775 billion and $12.795 billion, reflecting broad-based demand across sectors. McDermott said that “every business process in every industry is being refactored for agentic AI” and investors are buying it. Shares jumped 7% on the results.

Bottom Line: After a sluggish stretch earlier this year, ServiceNow is showing it can turn buzzwords into bookings. With over 528 customers now paying more than $5 million annually, AI isn’t just a flashy feature, it’s a revenue engine.

Calendar

On The Horizon

Tomorrow

Wall Street’s kicking off its sandals early tomorrow, with both earnings and economic calendars taking a breather ahead of the weekend. Think more iced coffee, less market chaos.

Durable goods orders headline an otherwise sleepy data day. On the earnings front, a handful of names will still report before packing up: HCA, Charter, Philips 66, Centene, Booz Allen, and AutoNation.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

NEWS

The Daily Rundown

💔 Hulk Hogan Dies at 71: Wrestling legend Terry "Hulk Hogan" Bollea passed away this morning from cardiac arrest at his Florida home. Emergency responders arrived at 9:51 a.m. and continued CPR for nearly 30 minutes before he was pronounced dead at Morton Plant Hospital. Hogan was a central figure in WWE’s rise during the 1980s and a two-time Hall of Famer, renowned for his charisma and record-setting matches. Tributes have poured in from peers and public figures, underscoring his lasting impact on sports and pop culture.

⚖️ Idaho Killer Sentenced to Multiple Life Terms: Bryan Kohberger was sentenced to multiple life sentences without parole after pleading guilty to murdering four University of Idaho students, per his plea deal. He also received a 10-year sentence for burglary, avoiding the death penalty by waiving a trial. Prosecutors relied on DNA evidence, surveillance footage, and cellphone data to secure the conviction. Kohberger has never explained his motive, leaving families without closure.

🎓 Columbia University to Pay $220M Settlement: Columbia University agreed to a $220 million settlement with the Trump administration to resolve claims it failed to protect Jewish students from harassment. The deal restores most of the federal funding that had been previously stripped away. It requires Columbia to implement reforms in governance, disciplinary policies, and oversight on antisemitism. The administration says it sets a new standard for campus civil rights enforcement.

👶 Court Says Trump’s Birthright Citizenship Order Unconstitutional: A federal appeals court in California ruled that President Trump’s executive order ending birthright citizenship is unconstitutional and blocked its enforcement nationwide. The 2–1 decision held that the order violates the plain language of the 14th Amendment. This is the first time an appellate court has ruled on the merits of Trump’s order. The decision is likely headed to the Supreme Court for final adjudication.

⚖️ Judge Denies Release of Epstein Grand Jury Transcripts: A federal judge in Florida denied the Trump administration’s request to unseal grand jury transcripts from the Jeffrey Epstein case. The judge found no legal justification for releasing the documents and reaffirmed that grand jury proceedings are generally secret. The ruling slows efforts to publicly disclose details of the investigation, despite public interest. Prosecutors had hoped the transcripts would provide more transparency but were rebuffed.

🍞 Aid Groups Warn of Mass Starvation in Gaza: More than 100 aid organizations warned of imminent mass starvation in Gaza, describing conditions as the result of a siege. Israel’s blockade and ongoing military operations have severely limited humanitarian aid delivery. UN agencies report widespread malnutrition, especially among children and vulnerable populations. Aid workers say a famine-like crisis is unfolding, calling for urgent international intervention.

🌍 UN Top Court Says Countries Can Sue Over Climate Harm: The UN’s highest court issued a nonbinding opinion that countries harmed by climate change can sue major emitters for failure to act. The ruling, backed by more than 130 nations, frames environmental protection as a legal obligation. It could serve as precedent for future climate litigation and compensation claims. The advisory opinion strengthens international accountability mechanisms.

⚖️ Macrons File Defamation Lawsuit Against Candace Owens: French President Emmanuel Macron and First Lady Brigitte Macron filed a defamation lawsuit in Delaware against conservative commentator Candace Owens. They accuse Owens of propagating false claims that Brigitte was born male, causing global harassment. The suit was filed after Owens ignored multiple demands to retract the statements. The couple is seeking damages and a jury trial, positioning the case as a fight against online disinformation.

REFERRAL

Share Investinq 🤝 Acquire Swag

If you love reading our newsletter, don’t be selfish — share it. Odds are your favorite finance bro, trader, investor, or stock market fanatic will too.

Don’t keep all the market news to yourself — share the love using the unique link below.

We deliver you all the news for free every single day (go on… help us out ;)

And here’s the kicker: every referral you make gets you entered into a raffle to win some awesome prizes listed below. Just share the link below and you’ll be entered once they sign up.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com