- Investinq

- Posts

- 🚚 Amazon's Same-Day Groceries

🚚 Amazon's Same-Day Groceries

+ Fast-Casual Slowdown: Cava, Chipotle, and Sweetgreen See Sales Stumble

Fabergé — the 182-year-old luxury house famous for jewel-encrusted imperial eggs — just got a new owner. Venture firm SMG Capital is shelling out $50 million for the brand, paying Gemfields $45 million upfront and another $5 million in royalties. Gemfields, which scooped up Fabergé in 2013 to market its emeralds and rubies, is cashing out to refocus on its mining operations in Zambia and Mozambique.

For SMG Capital’s Sergei Mosunov, the draw is Fabergé’s unmatched heritage and global cachet. The plan: keep making high-end jewelry, watches, and accessories while expanding the brand’s reach into new markets. For Gemfields, the sale marks the end of a glittery marketing chapter — and the start of a leaner, mine-first strategy.

MARKETS

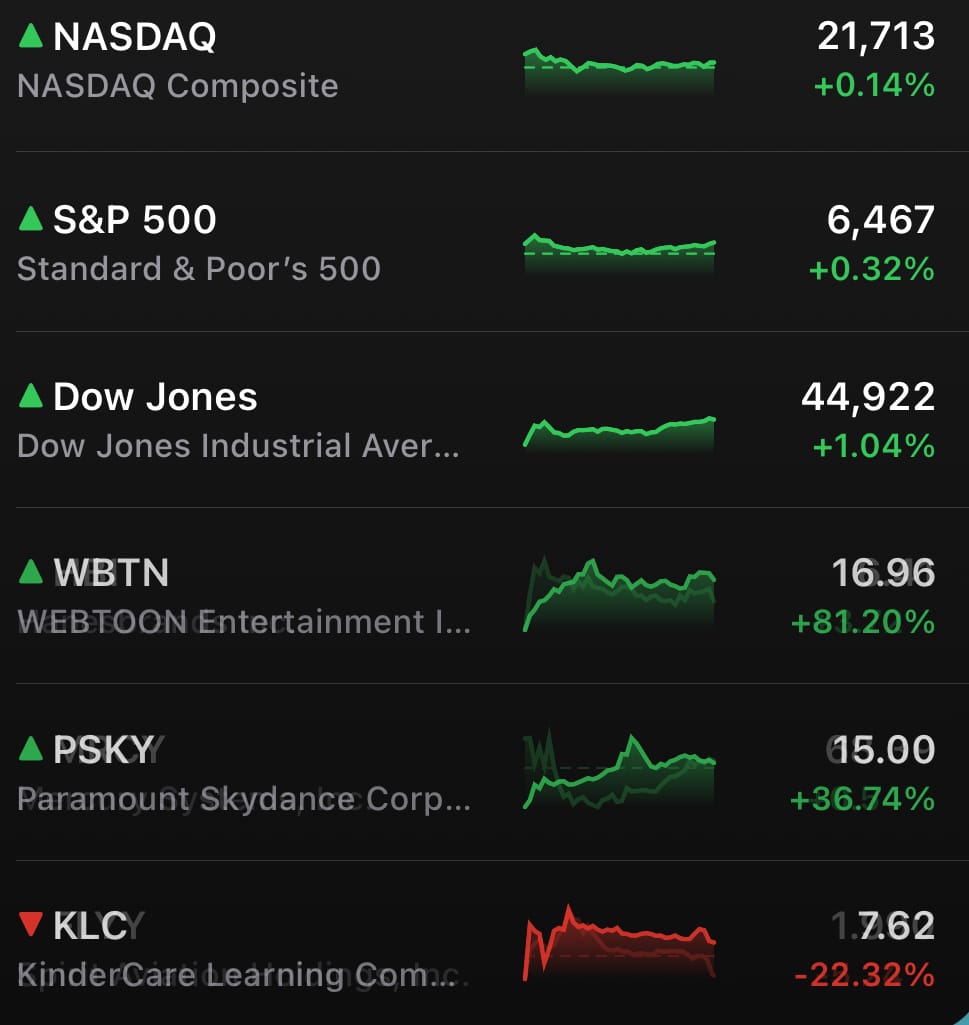

The S&P 500 logged its second straight record close, rising 0.3% and spending almost the entire day in the green. The Dow gained 1%, the Nasdaq barely held positive, and small caps stole the spotlight with the Russell 2000 jumping 2% as investors shifted away from mega-cap names. It’s the first time since April that the S&P’s advance-decline line has topped 300 for two consecutive sessions.

Rate-cut hopes kept the rally alive. Treasury Secretary Scott Bessent called for a hefty 50-basis-point trim in September, while President Trump hinted he may move early to replace Fed Chair Jerome Powell. With momentum building, both the S&P and Nasdaq ended the day at record highs — even after giving up some early gains.

Meet your new assistant (who happens to be AI).

Skej is your new scheduling assistant. Whether it’s a coffee intro, a client check-in, or a last-minute reschedule, Skej is on it. Just CC Skej on your emails, and it takes care of everything:

Customize your assistant name, email, and personality

Easily manages time zones and locales

Works with Google, Outlook, Zoom, Slack, and Teams

Skej works 24/7 in over 100 languages

No apps to download or new tools to learn. You talk to Skej just like a real assistant, and Skej just… works! It’s like having a super-organized co-worker with you all day.

STOCKS

Winners & Losers

What’s up 📈

Webtoon Entertainment exploded 81.20% after posting a surprise profit, strong sales, and announcing a new deal with Disney. ($WBTN)

Paramount Skydance jumped 36.74% as the newly merged entertainment company caught meme stock momentum. ($PSKY)

Hillenbrand gained 12.63% after Bloomberg reported the plastics producer may sell itself. ($HI)

V2X rose 10.28% after Bank of America upgraded the defense contractor to buy, citing sustainable and potentially accelerating growth. ($VVX)

SailPoint added 5.01% after JPMorgan upgraded the identity security stock to overweight, noting a post-lockup buying opportunity. ($SAIL)

Hanesbrands climbed 3.72% after agreeing to a $4.4 billion acquisition by Gildan Activewear. ($HBI)

180 Life Sciences Corp. rose 4.49% after announcing a rebrand to ETHZilla, tied to its $350 million Ethereum treasury. ($ATNF)

What’s down 📉

KinderCare Learning plunged 22.32% after missing Q2 sales and profit estimates, prompting a downgrade from Barclays. ($KLC)

CoreWeave fell 20.83% after beating revenue but missing profit forecasts, warning of continued high expenses. ($CRVW)

Circle Internet Group dropped 6.16% after IPO-related charges widened its net loss more than expected. ($CRCL)

H&R Block slipped 3.07% after issuing weaker-than-expected fiscal guidance despite an earnings beat. ($HRB)

Kroger lost over 4.38% and Albertsons fell over 1% after Amazon expanded same-day grocery delivery. ($KR, $ACI)

RETAIL

Amazon Launches Same-Day Delivery for Meat, Produce, and More in 1,000+ Cities

Amazon is making its boldest move yet into the grocery aisle, launching same-day delivery for meat, produce, eggs, and other perishables in 1,000 U.S. cities, with plans to more than double that footprint to 2,300 locations by year’s end. Prime members get the service free on orders over $25, while non-members pay $12.99 per delivery. The push marks Amazon’s attempt to claim more of the $875 billion grocery market, one of the few retail sectors where it still trails Walmart.

Shaking Up the Grocery Game

The announcement sent grocery competitors’ stocks tumbling. Instacart-owner Maplebear sank 11%, Kroger fell 4%, Albertsons dropped 2%, and DoorDash slid 3%. Even Walmart, which already offers same-day grocery delivery to over 90% of the U.S., saw shares dip nearly 2%. Analysts say the move intensifies the direct rivalry between Amazon and Walmart, with the former pouring billions into fresh food delivery and rural expansion, while the latter continues to bulk up its marketplace and ad business.

A Fresh Food Pivot

Historically, Amazon’s grocery business leaned heavily on nonperishable staples think toothpaste, bottled drinks, and canned goods that can be stored in warehouses. Now, the company is shifting toward fresh and perishable items, stocking them at delivery hubs to speed fulfillment. Early tests in cities like Phoenix showed that shoppers who bought fresh food were twice as likely to return compared to those who didn’t, a pattern Amazon hopes will stick nationwide.

Prime Positioning for Growth: The grocery expansion is part of Amazon’s broader push to reignite growth after some high-profile bets in healthcare, personal computing, and physical retail fell short of investor expectations. CEO Andy Jassy has long viewed groceries as a massive untapped opportunity, pointing to the $800 billion U.S. market in 2023. With Whole Foods under tighter integration and billions slated for expanding its delivery network, Amazon’s latest play could finally give it a seat at the head table in America’s grocery wars.

NEWS

Market Movements

🎬 Warner Bros. Discovery Surges on Asia Streaming Pact: Warner Bros. Discovery ($WBD) jumped 7.35% after striking a deal to bundle HBO Max with Southeast Asia’s Viu starting in Q4. The partnership gives Warner instant reach in markets like Indonesia, Malaysia, and Thailand while trimming marketing costs. The deal could strengthen margins ahead of the company’s planned split into two public entities.

💼 Capri Climbs on JPMorgan Upgrade: Capri Holdings ($CPRI) soared 12.28% after JPMorgan upgraded the Michael Kors parent to “overweight” with a $30 target. Analysts cited pricing power, fewer discounts, and a leaner store footprint as key growth drivers. They see steady gains ahead despite FTC challenges to its pending Tapestry acquisition.

💻 CoreWeave Tumbles on Target Cut: CoreWeave ($CRWV) sank 20.73% after Bank of America lowered its price target to $168 from $185, citing uncertainty over its Core Scientific deal and the upcoming IPO lockup expiration. Q3 sales guidance was slightly ahead of expectations, but operating income was below consensus. Analysts expect regulatory scrutiny and share pressure in the near term.

👕 Gildan Buys Hanesbrands: Gildan ($GIL) gained 11.85% and Hanesbrands ($HBI) rose 3.72% after Gildan agreed to buy Hanes for $2.2B, or $4.4B including debt. The deal would double Gildan’s revenue, creating a basics apparel giant spanning T-shirts, socks, and underwear. Hanes has struggled with falling sales and increased competition in recent years.

💰 Fidelity Assets Climb: Fidelity Investments’ assets under management hit $6.4T at the end of June. That’s up 9% from March and 16% from a year earlier. The increase came from gains in markets and inflows into the firm’s funds.

🛍 Walmart Boosts Employee Grocery Discount: Walmart ($WMT) will now give employees 10% off nearly all groceries. The discount previously only applied to fresh produce and general merchandise. The move is aimed at boosting employee benefits and retention.

🤖 Apple Preps AI Hardware Push: Apple ($AAPL) is developing a new AI product lineup including home-security cameras, a smart display speaker, and a tabletop robot with lifelike Siri. The robot is targeted for a 2027 release and will serve as a virtual companion. These devices are part of Apple’s push to reassert itself in the AI hardware market.

The Cross-Chain Giant Set for 1,000%+ Gains

As crypto markets surge, one multi-chain financial protocol is being targeted for massive institutional investment before retail discovers it.

Its transaction volume is skyrocketing across all major blockchains while its price remains suppressed as retail has yet to discover it – creating a coiled spring ready to release.

FOOD

Fast-Casual Slowdown: Cava, Chipotle, and Sweetgreen See Sales Stumble

Fast-casual’s golden era might be cooling off. After years of bucking industry trends, chains like Chipotle, Cava, and Sweetgreen are finally seeing diners tap the brakes. Cava’s Q2 earnings were the latest letdown, with same-store sales growth of just 2.1% far below the 6.1% Wall Street expected. That miss, along with a trimmed full-year forecast, sent shares plunging 16.6% and pushed its 2025 losses to nearly 38%.

From Feast to Famine

The slowdown isn’t unique to Cava. Shake Shack, Sweetgreen, and Chipotle have all reported back-to-back sales declines this year. Sweetgreen’s stock has cratered 70% year to date, while Chipotle has slid 28%. Executives are blaming everything from “economic fog” to cautious diners, especially among lower-income customers. With lunch prices climbing into the $14–$18 range and value menus running aggressive promotions, many office workers are skipping the grain bowls in favor of $5 meals or $3 snack wraps.

A Portion Problem: Part of the reputational hit comes from perception. Chipotle has faced social media backlash over allegedly shrinking portions (a claim it denies), while Sweetgreen’s rising prices have alienated salad fans. Industry research and consumer sentiment data suggest broader anxiety is also at play—Wingstop’s Michael Skipworth pointed to worries about elevated prices, job security, and the economy at large. The University of Michigan’s consumer sentiment index hit historic lows earlier this year before rebounding slightly in summer, but the spending slowdown hasn’t fully reversed.

Automation to the Rescue?

To counter rising labor costs and win back customers, bowl slingers are experimenting with automation. Sweetgreen’s “Infinite Kitchen” makeline has lowered labor costs in test locations. Chipotle is piloting Hyphen’s robotic assembly systems, and Cava plans to roll them out as well. The hope: faster service, consistent portions, and maybe even a few menu price cuts. Whether a robot can make a tastier, more cost-effective bowl—and whether customers will still tip it—remains to be seen.

Calendar

On The Horizon

Tomorrow

Tomorrow’s economic calendar swaps CPI for its less glamorous cousin, PPI — a gauge of wholesale-level inflation — plus the latest weekly jobless claims. Enjoy those labor stats while they last: President Trump’s pick to lead the BLS, E.J. Antoni, has floated the idea of scrapping the monthly jobs report altogether. On the earnings front, JD. com, Applied Materials, Advance Auto Parts, and Deere & Co. will step up to the plate.

Before Market Open:

One quirkier name to watch? Birkenstock. The comfort-first shoemaker logged 19% revenue growth last quarter, fueled by booming overseas demand — China sales more than doubled — and a steady focus on premium products that keep margins cushy. Consensus calls for $0.67 EPS on $739.49 million in revenue, proving that even “ugly” shoes can look beautiful on a balance sheet.

NEWS

The Daily Rundown

📰 Google Adds Customizable Top Stories: Google is launching a feature allowing users to choose which news outlets appear in their Top Stories search results. The update gives readers more control over the sources they see, which could significantly impact traffic to certain publishers. It marks a notable shift in how Google curates news for its users, offering a more tailored experience.

🏛 White House to Review Smithsonian Museums: The White House will conduct a review of Smithsonian museums to ensure they align with President Trump’s interpretation of history, the Wall Street Journal reported. Because DC is a federal district, the administration has the authority to implement such changes. The review could reshape how exhibits are curated and presented.

🏛 Trump Floats Lawsuit Against Fed Chair Over HQ Renovations:

President Trump is considering suing Federal Reserve Chair Jerome Powell, calling the renovations at the Fed’s Washington headquarters “grossly incompetent.” The move aligns with Trump’s renewed pressure on the Fed to cut interest rates ahead of his economic agenda. White House officials say the lawsuit threat stems from concerns about excessive spending on the project.✂️ Vanity Fair Cuts Staff and Reviews Section: Vanity Fair is eliminating its reviews section and laying off some staffers in one of the first moves by new Editorial Director Mark Guiducci. The decision reflects a shift in editorial focus as the magazine redefines its coverage priorities. It’s part of broader changes in Condé Nast’s portfolio as the company adapts to evolving media consumption.

💬 Trump Targets Goldman Sachs Over Forecast: President Trump criticized Goldman Sachs CEO David Solomon and said the bank should replace its chief economist. He accused the economist of making a “bad prediction” about the economy, adding pressure on financial leaders. The remarks come as Trump continues to weigh in on Wall Street forecasts.

🎬 Daniel Day-Lewis Returns to Film in ‘Anemone’: Daniel Day-Lewis will star in Anemone, his first film in eight years, directed by his son Ronan Day-Lewis. The drama marks a rare return for the three-time Oscar winner, who retired from acting in 2017. Filming is set to draw significant attention from both film critics and fans.

REFERRAL

Share Investinq 🤝 Acquire Swag

If you love reading our newsletter, don’t be selfish — share it. Odds are your favorite finance bro, trader, investor, or stock market fanatic will too.

Don’t keep all the market news to yourself — share the love using the unique link below.

We deliver you all the news for free every single day (go on… help us out ;)

And here’s the kicker: every referral you make gets you entered into a raffle to win some awesome prizes listed below. Just share the link below and you’ll be entered once they sign up.

RESOURCES

The Federal Reserve Resource

Join our small yet growing subreddit 🚀: https://www.reddit.com/r/investinq/

Wall Street Reads 💎 (Best Books):

Stock Market Books📚

https://drive.google.com/file/d/1NQ-vdLE1afXFcc5PwDRp1d5VSHzDly88/view?usp=sharingOptions Trading Books📗 https://drive.google.com/file/d/1xeYL3IpjT623CJpO_Ole1Z-GuzHQQJzg/view?usp=sharing

Business Books 📖https://drive.google.com/file/d/1VfuTqhPVB2YjDOd0N56UhF6kmZU-kLci/view?usp=sharing

Check out our latest issues 🎯: https://investinq.beehiiv.com